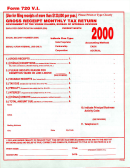

Form 4700 - Gross Receipts Worksheet Page 5

ADVERTISEMENT

4700, Page 5

Additional instructions

a) For purposes of this provision, a hedging transaction is one entered into by the taxpayer in the normal course of the taxpayer’s trade or business primarily

to manage (i) risk of exposure to foreign currency fluctuations that affect assets, liabilities, profits, losses, equity, or investments in foreign operations; (ii)

interest rate fluctuations; or (iii) commodity price fluctuations. Transfer of title of real or tangible personal property is not a hedging transaction. “Hedging

transaction” means that term as defined under IRC § 1221 regardless of whether the transaction was identified by the taxpayer as a hedge for federal

income tax purposes, provided, however, that transactions not identified as a hedge for federal income tax purposes shall be identifiable to the department

by the taxpayer as a hedge in its books and records.

b) For purposes of this provision, a person principally engaged in the trade or business of purchasing and selling investment and trading assets is not

performing a treasury function. “Treasury function” means the pooling and management of investment and trading assets for the purpose of satisfying cash

flow or liquidity needs of the taxpayer’s trade or business.

c) “Mortgage company” means a person that is licensed under MCL § 445.1651 to 445.1684, or MCL § 493.51 to 493.81, and has greater than 90 percent

of its revenues, in the ordinary course of business, from the origination, sale, or servicing of residential mortgage loans.

d) Professional employer organization is not the same thing as a staffing company, and it means an organization that provides the management and

administration of the human resources of another entity by contractually assuming substantial employer rights and responsibilities through a professional

employer agreement that establishes an employer relationship with the leased officers or employees assigned to the other entity by doing all of the

following:

• Maintaining a right of direction and control of employees’ work, although this responsibility may be shared with the other entity.

• Paying wages and employment taxes of the employees out of its own accounts.

• Reporting, collecting, and depositing state and federal employment taxes for the employees.

• Retaining a right to hire and fire employees.

e) For purposes of this provision, a person is related to an individual if that person is a spouse, brother or sister, whether of the whole or half blood or

by adoption, ancestor, lineal descendent of that individual or related person, or a trust benefiting that individual or one or more persons related to that

individual.

f) For this provision, the following definitions apply: Cooperative Corporation means those organizations described under subchapter T of the IRC; Pass-

through entity means a partnership, subchapter S Corporation, or other person, other than an individual, that is not classified for Federal Income Tax

purposes as an association taxed as a corporation; Real estate investment trust means the term defined under IRC § 856; and Regulated investment

company means the term defined under IRC § 851.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5