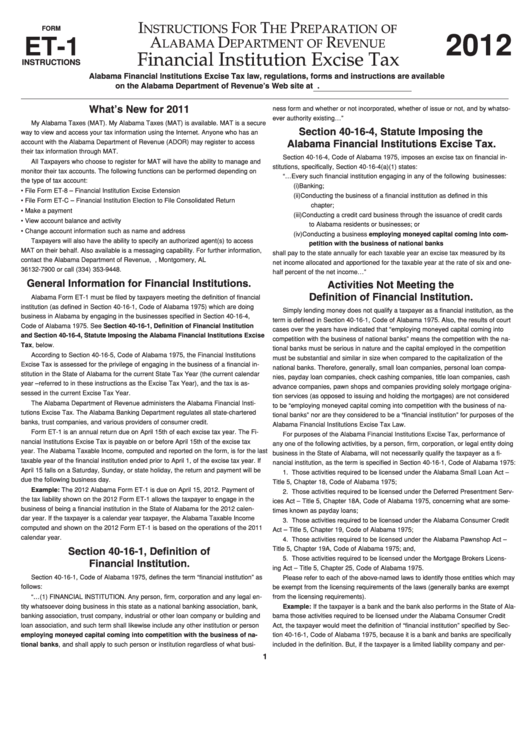

Form Et-1 Instructions - Financial Institution Excise Tax - 2012

ADVERTISEMENT

I

F

T

P

NSTRUCTIONS

OR

HE

REPARATION OF

FORM

2012

ET-1

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Financial Institution Excise Tax

INSTRUCTIONS

Alabama Financial Institutions Excise Tax law, regulations, forms and instructions are available

on the Alabama Department of Revenue’s Web site at

What’s New for 2011

ness form and whether or not incorporated, whether of issue or not, and by whatso-

ever authority existing…”

My Alabama Taxes (MAT). My Alabama Taxes (MAT) is available. MAT is a secure

Section 40-16-4, Statute Imposing the

way to view and access your tax information using the Internet. Anyone who has an

account with the Alabama Department of Revenue (ADOR) may register to access

Alabama Financial Institutions Excise Tax.

their tax information through MAT.

Section 40-16-4, Code of Alabama 1975, imposes an excise tax on financial in-

All Taxpayers who choose to register for MAT will have the ability to manage and

stitutions, specifically, Section 40-16-4(a)(1) states:

monitor their tax accounts. The following functions can be performed depending on

“…Every such financial institution engaging in any of the following businesses:

the type of tax account:

(i)

Banking;

• File Form ET-8 – Financial Institution Excise Extension

(ii)

Conducting the business of a financial institution as defined in this

• File Form ET-C – Financial Institution Election to File Consolidated Return

chapter;

• Make a payment

(iii) Conducting a credit card business through the issuance of credit cards

• View account balance and activity

to Alabama residents or businesses; or

• Change account information such as name and address

(iv) Conducting a business employing moneyed capital coming into com-

Taxpayers will also have the ability to specify an authorized agent(s) to access

petition with the business of national banks

MAT on their behalf. Also available is a messaging capability. For further information,

shall pay to the state annually for each taxable year an excise tax measured by its

contact the Alabama Department of Revenue, P.O. Box 327900, Montgomery, AL

net income allocated and apportioned for the taxable year at the rate of six and one-

36132-7900 or call (334) 353-9448.

half percent of the net income…”

General Information for Financial Institutions.

Activities Not Meeting the

Definition of Financial Institution.

Alabama Form ET-1 must be filed by taxpayers meeting the definition of financial

institution (as defined in Section 40-16-1, Code of Alabama 1975) which are doing

Simply lending money does not qualify a taxpayer as a financial institution, as the

business in Alabama by engaging in the businesses specified in Section 40-16-4,

term is defined in Section 40-16-1, Code of Alabama 1975. Also, the results of court

Code of Alabama 1975. See Section 40-16-1, Definition of Financial Institution

cases over the years have indicated that “employing moneyed capital coming into

and Section 40-16-4, Statute Imposing the Alabama Financial Institutions Excise

competition with the business of national banks” means the competition with the na-

Tax, below.

tional banks must be serious in nature and the capital employed in the competition

According to Section 40-16-5, Code of Alabama 1975, the Financial Institutions

must be substantial and similar in size when compared to the capitalization of the

Excise Tax is assessed for the privilege of engaging in the business of a financial in-

national banks. Therefore, generally, small loan companies, personal loan compa-

stitution in the State of Alabama for the current State Tax Year (the current calendar

nies, payday loan companies, check cashing companies, title loan companies, cash

year – referred to in these instructions as the Excise Tax Year), and the tax is as-

advance companies, pawn shops and companies providing solely mortgage origina-

sessed in the current Excise Tax Year.

tion services (as opposed to issuing and holding the mortgages) are not considered

The Alabama Department of Revenue administers the Alabama Financial Insti-

to be “employing moneyed capital coming into competition with the business of na-

tutions Excise Tax. The Alabama Banking Department regulates all state-chartered

tional banks” nor are they considered to be a “financial institution” for purposes of the

banks, trust companies, and various providers of consumer credit.

Alabama Financial Institutions Excise Tax Law.

Form ET-1 is an annual return due on April 15th of each excise tax year. The Fi-

For purposes of the Alabama Financial Institutions Excise Tax, performance of

nancial Institutions Excise Tax is payable on or before April 15th of the excise tax

any one of the following activities, by a person, firm, corporation, or legal entity doing

year. The Alabama Taxable Income, computed and reported on the form, is for the last

business in the State of Alabama, will not necessarily qualify the taxpayer as a fi-

taxable year of the financial institution ended prior to April 1, of the excise tax year. If

nancial institution, as the term is specified in Section 40-16-1, Code of Alabama 1975:

April 15 falls on a Saturday, Sunday, or state holiday, the return and payment will be

1. Those activities required to be licensed under the Alabama Small Loan Act –

due the following business day.

Title 5, Chapter 18, Code of Alabama 1975;

Example: The 2012 Alabama Form ET-1 is due on April 15, 2012. Payment of

2. Those activities required to be licensed under the Deferred Presentment Serv-

the tax liability shown on the 2012 Form ET-1 allows the taxpayer to engage in the

ices Act – Title 5, Chapter 18A, Code of Alabama 1975, concerning what are some-

business of being a financial institution in the State of Alabama for the 2012 calen-

times known as payday loans;

dar year. If the taxpayer is a calendar year taxpayer, the Alabama Taxable Income

3. Those activities required to be licensed under the Alabama Consumer Credit

computed and shown on the 2012 Form ET-1 is based on the operations of the 2011

Act – Title 5, Chapter 19, Code of Alabama 1975;

calendar year.

4. Those activities required to be licensed under the Alabama Pawnshop Act –

Title 5, Chapter 19A, Code of Alabama 1975; and,

Section 40-16-1, Definition of

5. Those activities required to be licensed under the Mortgage Brokers Licens-

Financial Institution.

ing Act – Title 5, Chapter 25, Code of Alabama 1975.

Section 40-16-1, Code of Alabama 1975, defines the term “financial institution” as

Please refer to each of the above-named laws to identify those entities which may

follows:

be exempt from the licensing requirements of the laws (generally banks are exempt

“…(1) FINANCIAL INSTITUTION. Any person, firm, corporation and any legal en-

from the licensing requirements).

tity whatsoever doing business in this state as a national banking association, bank,

Example: If the taxpayer is a bank and the bank also performs in the State of Ala-

banking association, trust company, industrial or other loan company or building and

bama those activities required to be licensed under the Alabama Consumer Credit

loan association, and such term shall likewise include any other institution or person

Act, the taxpayer would meet the definition of “financial institution” specified by Sec-

employing moneyed capital coming into competition with the business of na-

tion 40-16-1, Code of Alabama 1975, because it is a bank and banks are specifically

tional banks, and shall apply to such person or institution regardless of what busi-

included in the definition. But, if the taxpayer is a limited liability company and per-

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6