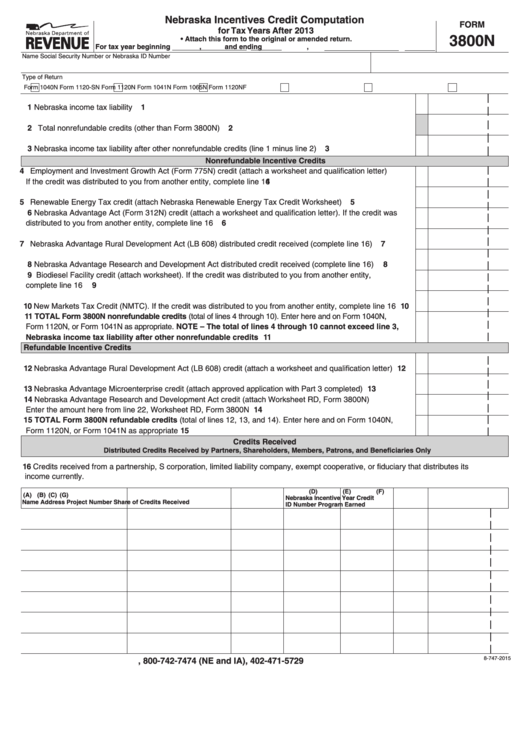

Nebraska Incentives Credit Computation

FORM

for Tax Years After 2013

3800N

• Attach this form to the original or amended return.

For tax year beginning

,

and ending

,

Name

Social Security Number or Nebraska ID Number

Type of Return

Form 1040N

Form 1120-SN

Form 1120N

Form 1041N

Form 1065N

Form 1120NF

1 Nebraska income tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Total nonrefundable credits (other than Form 3800N) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Nebraska income tax liability after other nonrefundable credits (line 1 minus line 2) . . . . . . . . . . . . . . . . . . . . . .

3

Nonrefundable Incentive Credits

4 Employment and Investment Growth Act (Form 775N) credit (attach a worksheet and qualification letter)

4

If the credit was distributed to you from another entity, complete line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Renewable Energy Tax credit (attach Nebraska Renewable Energy Tax Credit Worksheet) . . . . . . . . . . . . . . . . .

5

6 Nebraska Advantage Act (Form 312N) credit (attach a worksheet and qualification letter). If the credit was

6

distributed to you from another entity, complete line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Nebraska Advantage Rural Development Act (LB 608) distributed credit received (complete line 16) . . . . . . . . .

7

8 Nebraska Advantage Research and Development Act distributed credit received (complete line 16) . . . . . . . . . .

8

9 Biodiesel Facility credit (attach worksheet). If the credit was distributed to you from another entity,

9

complete line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 New Markets Tax Credit (NMTC). If the credit was distributed to you from another entity, complete line 16 . . . . . 10

11 TOTAL Form 3800N nonrefundable credits (total of lines 4 through 10). Enter here and on Form 1040N,

Form 1120N, or Form 1041N as appropriate. NOTE – The total of lines 4 through 10 cannot exceed line 3,

Nebraska income tax liability after other nonrefundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Refundable Incentive Credits

12 Nebraska Advantage Rural Development Act (LB 608) credit (attach a worksheet and qualification letter) . . . . . 12

13 Nebraska Advantage Microenterprise credit (attach approved application with Part 3 completed) . . . . . . . . . . . . 13

14 Nebraska Advantage Research and Development Act credit (attach Worksheet RD, Form 3800N)

Enter the amount here from line 22, Worksheet RD, Form 3800N . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 TOTAL Form 3800N refundable credits (total of lines 12, 13, and 14). Enter here and on Form 1040N,

Form 1120N, or Form 1041N as appropriate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Credits Received

Distributed Credits Received by Partners, Shareholders, Members, Patrons, and Beneficiaries Only

16 Credits received from a partnership, S corporation, limited liability company, exempt cooperative, or fiduciary that distributes its

income currently.

(D)

(E)

(F)

(A)

(B)

(C)

(G)

Nebraska

Incentive

Year Credit

Name

Address

Project Number

Share of Credits Received

ID Number

Program

Earned

8-747-2015

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

1

1 2

2 3

3