Form Dtf-801 - Certificate Of Individual Indian Exemption For Certain Property Or Services Delivered On A Reservation

ADVERTISEMENT

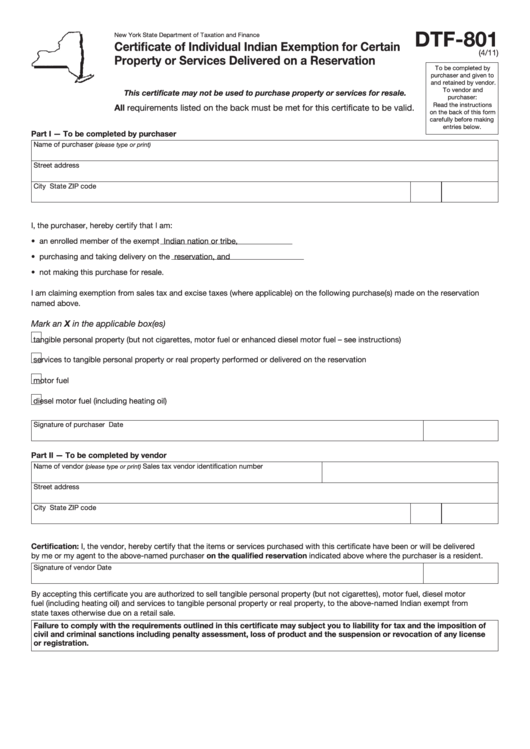

DTF-801

New York State Department of Taxation and Finance

Certificate of Individual Indian Exemption for Certain

(4/11)

Property or Services Delivered on a Reservation

To be completed by

purchaser and given to

and retained by vendor.

To vendor and

This certificate may not be used to purchase property or services for resale.

purchaser:

Read the instructions

All requirements listed on the back must be met for this certificate to be valid.

on the back of this form

carefully before making

entries below.

Part I — To be completed by purchaser

Name of purchaser

(please type or print)

Street address

City

State

ZIP code

I, the purchaser, hereby certify that I am:

• an enrolled member of the exempt

Indian nation or tribe,

• purchasing and taking delivery on the

reservation, and

• not making this purchase for resale.

I am claiming exemption from sales tax and excise taxes (where applicable) on the following purchase(s) made on the reservation

named above.

Mark an X in the applicable box(es)

tangible personal property (but not cigarettes, motor fuel or enhanced diesel motor fuel – see instructions)

services to tangible personal property or real property performed or delivered on the reservation

motor fuel

diesel motor fuel (including heating oil)

Signature of purchaser

Date

Part II — To be completed by vendor

Name of vendor

Sales tax vendor identification number

(please type or print)

Street address

City

State

ZIP code

Certification: I, the vendor, hereby certify that the items or services purchased with this certificate have been or will be delivered

by me or my agent to the above-named purchaser on the qualified reservation indicated above where the purchaser is a resident.

Signature of vendor

Date

By accepting this certificate you are authorized to sell tangible personal property (but not cigarettes), motor fuel, diesel motor

fuel (including heating oil) and services to tangible personal property or real property, to the above-named Indian exempt from

state taxes otherwise due on a retail sale.

Failure to comply with the requirements outlined in this certificate may subject you to liability for tax and the imposition of

civil and criminal sanctions including penalty assessment, loss of product and the suspension or revocation of any license

or registration.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2