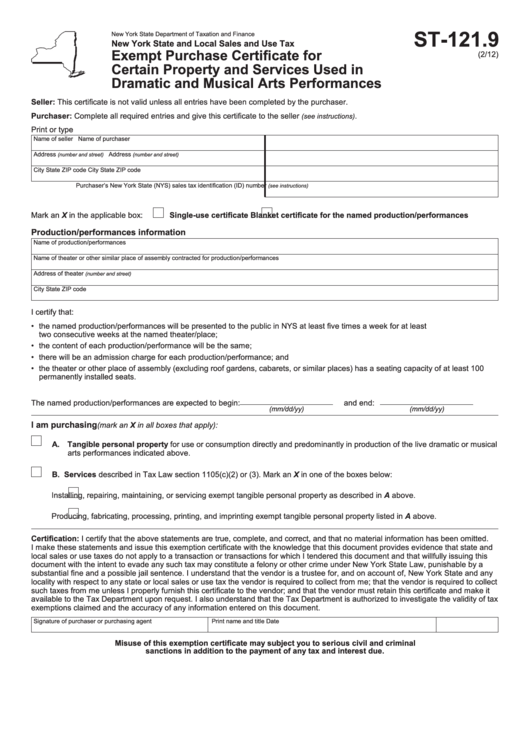

ST-121.9

New York State Department of Taxation and Finance

New York State and Local Sales and Use Tax

Exempt Purchase Certificate for

(2/12)

Certain Property and Services Used in

Dramatic and Musical Arts Performances

Seller: This certificate is not valid unless all entries have been completed by the purchaser.

Purchaser: Complete all required entries and give this certificate to the seller

.

(see instructions)

Print or type

Name of seller

Name of purchaser

Address

Address

(number and street)

(number and street)

City

State

ZIP code

City

State

ZIP code

Purchaser’s New York State (NYS) sales tax identification (ID) number

(see instructions)

Single-use certificate

Blanket certificate for the named production/performances

Mark an X in the applicable box:

Production/performances information

Name of production/performances

Name of theater or other similar place of assembly contracted for production/performances

Address of theater

(number and street)

City

State

ZIP code

I certify that:

• the named production/performances will be presented to the public in NYS at least five times a week for at least

two consecutive weeks at the named theater/place;

• the content of each production/performance will be the same;

• there will be an admission charge for each production/performance; and

• the theater or other place of assembly (excluding roof gardens, cabarets, or similar places) has a seating capacity of at least 100

permanently installed seats.

The named production/performances are expected to begin:

and end:

(mm/dd/yy)

(mm/dd/yy)

I am purchasing

(mark an X in all boxes that apply):

A. Tangible personal property for use or consumption directly and predominantly in production of the live dramatic or musical

arts performances indicated above.

B. Services described in Tax Law section 1105(c)(2) or (3). Mark an X in one of the boxes below:

Installing, repairing, maintaining, or servicing exempt tangible personal property as described in A above.

Producing, fabricating, processing, printing, and imprinting exempt tangible personal property listed in A above.

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted.

I make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and

local sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this

document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a

substantial fine and a possible jail sentence. I understand that the vendor is a trustee for, and on account of, New York State and any

locality with respect to any state or local sales or use tax the vendor is required to collect from me; that the vendor is required to collect

such taxes from me unless I properly furnish this certificate to the vendor; and that the vendor must retain this certificate and make it

available to the Tax Department upon request. I also understand that the Tax Department is authorized to investigate the validity of tax

exemptions claimed and the accuracy of any information entered on this document.

Signature of purchaser or purchasing agent

Print name and title

Date

Misuse of this exemption certificate may subject you to serious civil and criminal

sanctions in addition to the payment of any tax and interest due.

1

1 2

2