Form 720-V - Electronic Filing Payment Voucher - 2013

ADVERTISEMENT

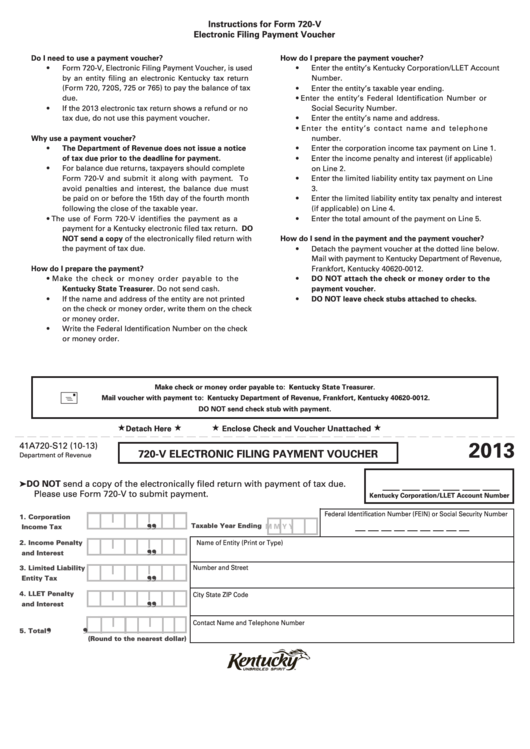

Instructions for Form 720-V

Electronic Filing Payment Voucher

Do I need to use a payment voucher?

How do I prepare the payment voucher?

•

Form 720-V, Electronic Filing Payment Voucher, is used

•

Enter the entity’s Kentucky Corporation/LLET Account

by an entity filing an electronic Kentucky tax return

Number.

(Form 720, 720S, 725 or 765) to pay the balance of tax

•

Enter the entity’s taxable year ending.

due.

•

Enter the entity’s Federal Identification Number or

•

If the 2013 electronic tax return shows a refund or no

Social Security Number.

tax due, do not use this payment voucher.

•

Enter the entity’s name and address.

•

Enter the entity’s contact name and telephone

Why use a payment voucher?

number.

•

The Department of Revenue does not issue a notice

•

Enter the corporation income tax payment on Line 1.

of tax due prior to the deadline for payment.

•

Enter the income penalty and interest (if applicable)

•

For balance due returns, taxpayers should complete

on Line 2.

Form 720-V and submit it along with payment. To

•

Enter the limited liability entity tax payment on Line

avoid penalties and interest, the balance due must

3.

be paid on or before the 15th day of the fourth month

•

Enter the limited liability entity tax penalty and interest

following the close of the taxable year.

(if applicable) on Line 4.

•

The use of Form 720-V identifies the payment as a

•

Enter the total amount of the payment on Line 5.

payment for a Kentucky electronic filed tax return. DO

NOT send a copy of the electronically filed return with

How do I send in the payment and the payment voucher?

the payment of tax due.

•

Detach the payment voucher at the dotted line below.

Mail with payment to Kentucky Department of Revenue,

How do I prepare the payment?

Frankfort, Kentucky 40620-0012.

•

Make the check or money order payable to the

•

DO NOT attach the check or money order to the

Kentucky State Treasurer. Do not send cash.

payment voucher.

•

If the name and address of the entity are not printed

•

DO NOT leave check stubs attached to checks.

on the check or money order, write them on the check

or money order.

•

Write the Federal Identification Number on the check

or money order.

Make check or money order payable to: Kentucky State Treasurer.

Mail voucher with payment to: Kentucky Department of Revenue, Frankfort, Kentucky 40620-0012.

DO NOT send check stub with payment.

Detach Here

Enclose Check and Voucher Unattached

2013

41A720-S12 (10-13)

720-V ELECTRONIC FILING PAYMENT VOUCHER

Department of Revenue

DO NOT send a copy of the electronically filed return with payment of tax due.

➤

Please use Form 720-V to submit payment.

Kentucky Corporation/LLET Account Number

Federal Identification Number (FEIN) or Social Security Number

1. Corporation

Taxable Year Ending

❜

❜

M M Y

Y

Income Tax

2. Income Penalty

Name of Entity (Print or Type)

❜

❜

and Interest

3. Limited Liability

Number and Street

Entity Tax

❜

❜

4. LLET Penalty

City

State

ZIP Code

and Interest

❜

❜

Contact Name and Telephone Number

5. Total

❜

❜

(Round to the nearest dollar)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1