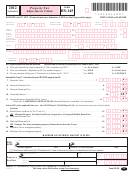

Form Hs-145 - Vermont Property Tax Adjustment Claim - 2012 Page 2

ADVERTISEMENT

Instructions for Form HS-145

Property Tax Adjustment Claim

You may be eligible for an adjustment of your homestead property tax if:

Line 2 Legal Residence Enter the town or city name of your legal residence

(1) the property is your declared homestead; (2) you were a VT resident

as of April 1, 2012. If there is both a city and town with the same name,

for the entire 2011 calendar year; (3) you own and occupy the property as

please specify. Examples: Barre City or Barre Town

St. Albans City or

your principal residence as of April 1, 2012; (4) you are not claimed as a

St. Albans Town

dependent of another taxpayer for the 2011 tax year; and (5) you meet the

Line 3 SPAN (School Property Account Number) This is a unique

household income criteria.

11 -digit identification number assigned by the town or city and is printed on

See page 51 in the 2011 tax year income tax booklet for information on

the property tax bill. It is very important to verify your SPAN. The property

property held by a trust, holders of a life estate, and homesteads located on

tax adjustment is credited to the property tax bill for this SPAN.

a farm.

Lines 4 - 6 Eligibility Questions

Check the appropriate “Yes” or “No”

Also see Definitions, Special Situations, Ownership Situations and Buying

box to answer the eligibility questions. ALL eligibility questions must be

and Selling Property sections starting at page 49 of the 2011 tax year income

answered or the claim cannot be processed.

tax booklet.

Information for Lines 7 - 9 is found on your property tax bill.

Selling Your Property Before April 1, 2012 If you filed a claim before

Line 7 Housesite Value Enter the value assessed by the town or city as of

April 1, 2012, you must notify the Department of the sale and withdraw

April 1, 2011 and found on the 2011/2012 property tax bill. See page 51 of

the claim using Form HS-132. Withdrawal can be done at the time of the

the 2011 tax year income tax booklet for information on new construction or

property sale closing and is available through the free, online filing program

purchase of a new home.

at

Line 8 Housesite Education Tax

Enter the education property tax as

Deceased Homeowner See page 50 of the 2011 tax year income tax booklet.

shown on your 2011/2012 property tax bill.

Buying A Home On Or Before April 1, 2012 You must file Form HS-131,

Household Income less than $90,000 - the education property tax eligible

Homestead Declaration, by April 17, 2012 to make a property tax adjustment

for adjustment is based on the tax assessed or tax on $500,000 equalized

claim. Declaring the new property as a homestead can be done at the time of

housesite value, whichever is less.

the property closing and is available through the free, online filing program

Household Income $90,000 or more - the education property tax eligible

at

for adjustment is based on the tax assessed or tax on $200,000 equalized

Due Date - APRIL 17, 2012 Property Tax Adjustment Claims may also

housesite value, whichever is less.

be filed between April 18 and September

4,

2012; however, a $15 late filing

Line 9 Municipal Tax

Homeowners with $47,000 or less household

penalty is deducted.

income may be eligible for adjustment on municipal property tax. Enter the

2012 Property Tax Adjustment Claims filed after September

4,

2012 cannot

municipal property tax as shown on your 2011/2012 property tax bill.

be accepted.

Line 10 Ownership Interest If you and the members of the household own

Receipt Date Forms mailed through the U. S. Post Office are considered

and occupy the property as your principal home, enter 100.00%. If there is

timely if received by the Department within 3 business days of the due date.

another owner(s) that does not live in the household or you live in a duplex,

If you file electronically, the receipt date is the transmission date. If you

see page 51 of the 2011 tax year income tax booklet for more information.

bring the form to the Department in person, it must be on or before the due

Line 11 Household Income Enter the amount calculated on Schedule

date.

HI-144, Line y. See page 52 of the 2011 tax year income tax booklet on

Extension of Time There is NO extension of time to file Form HS-145. See

calculating household income when you have an extension of time for your

page 52 of the 2011 tax year income tax booklet on calculating household

income tax return.

income when you have an extension of time for your income tax return.

Select ONE of the applicable line sets: Line 12 OR Lines 13-14 OR

Amending Form HS-145

An error on the 2012 Form HS-145 may be

Lines 15-16. Line 12 Lot Rent for a Mobile Home If you rent a lot in a

corrected up to September

4,

2012. After that date, only household income

for-profit mobile home park, obtain Form LC-142, Landlord Certificate, and

may be amended. See page 52 for information on amending household

enter the amount of allocable rent from LC-142, Line 16.

income.

Lines 13 - 14 Allocated Tax from Land Trust, Cooperative or Nonprofit

OFFSET / INJURED SPOUSE CLAIMS If your spouse or civil union

Mobile Home Park Enter the amount of education and municipal property

partner has a bill for VT tax or from VT state agency and you filed jointly,

tax shown on the statement issued to you by the land trust, cooperative or

the property tax adjustment will be used to pay the bill. If you are not

nonprofit mobile home park.

responsible for the bill, file an “injured spouse” claim. You may receive the

Lines 15 – 16 Property Tax from Contiguous Property If you own

portion of the property tax adjustment equal to your ownership percentage

contiguous property, you can use the property taxes from that parcel if the

of the homestead. To make an “injured spouse” claim, send the following

property tax bill for your dwelling has under 2 acres or part of the dwelling or

information separate from your claim (1) the request letter; (2) copy of

a building such as garage is on the contiguous property. Example: (1) Your

Federal Form 8379 (if you filed one with the IRS); (3) documentation of your

dwelling is on .75 acre of land and you own 5 acres contiguous to the dwelling

ownership interest to: VT Department of Taxes, ATTN: Injured Spouse Unit,

land. The property taxes on 1.25 acres can be entered here and is eligible for

PO Box 1645, Montpelier VT 05601-1645.

property tax adjustment. (2) Your dwelling is on 1 acre and your garage is on

3 acres that is contiguous to your dwelling. The property taxes on the garage

LINE-BY-LINE INSTRUCTIONS

and 1 acre can be entered here and is eligible for property tax adjustment.

Complete Schedule HI-144 first to determine if you meet the household

income criteria.

MAXIMUM 2012 PROPERTY TAX ADJUSTMENT IS $8,000

Schedule HI-144 must be submitted with Form HS-145. See instructions for

The property tax adjustment will appear as a credit on your 2012/2013

Line 12 and Lines 13 & 14 for additional documents that may be required.

property tax bill.

Claimant Information: Enter your Social Security number, name and

Signature Sign the property tax adjustment form.

address. If applicable, enter the Social Security number and name of your

spouse/civil union partner. Enter your date of birth. Example: March 27,

Date Write the date you signed this form.

1948 date of birth is entered as 03 27 1948

Disclosure Authorization þ Check this box if you wish to give the Vermont

Location of Homestead Enter the physical location (street, road name)

Department of Taxes authorization to discuss this form with your tax preparer.

Examples: 123 Maple Street

276 Route 12A

Please do not use a post

Be sure the tax preparer’s name is included.

office box or write in “same,” “see above” or the city/town name.

Preparer If you are a paid preparer, you must sign this form, enter your

Line 1 VT School District Code Enter the 3-digit school district code

Social Security number or PTIN, and if employed by a business, include the

where you pay education property tax as of April 1, 2012. Most towns print

EIN of the business. If someone other than the Homeowner prepared this

the code on the property tax bill. A school district code chart is available

form without charging a fee, the preparer signature is optional.

at or in the income tax booklet. Be sure to use the

school district code for the physical location of the homestead as this may be

different from the town used in your mailing address.

36

Form HS-145

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2