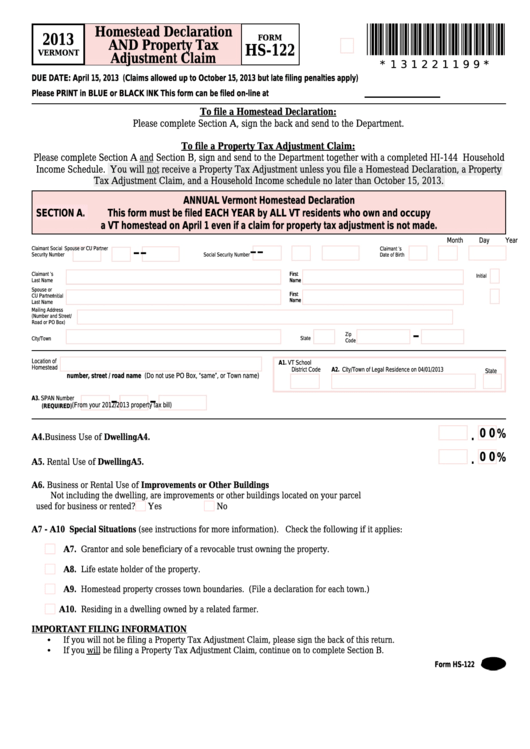

Form Hs-122 - Vermont Homestead Declaration And Property Tax Adjustment Claim - 2013

ADVERTISEMENT

*131221199*

Homestead Declaration

2013

FORM

AND Property Tax

HS-122

VERMONT

Adjustment Claim

* 1 3 1 2 2 1 1 9 9 *

DUE DATE: April 15, 2013 (Claims allowed up to October 15, 2013 but late filing penalties apply)

Please PRINT in BLUE or BLACK INK

This form can be filed on-line at

To file a Homestead Declaration:

Please complete Section A, sign the back and send to the Department .

To file a Property Tax Adjustment Claim:

Please complete Section A and Section B, sign and send to the Department together with a completed HI-144 Household

Income Schedule . You will not receive a Property Tax Adjustment unless you file a Homestead Declaration, a Property

Tax Adjustment Claim, and a Household Income schedule no later than October 15, 2013 .

ANNUAL Vermont Homestead Declaration

SECTION A.

This form must be filed EACH YEAR by ALL VT residents who own and occupy

a VT homestead on April 1 even if a claim for property tax adjustment is not made.

Month

Day

Year

-

-

-

-

Claimant Social

Spouse or CU Partner

Claimant ’s

Security Number

Social Security Number

Date of Birth

Claimant ’s

First

First

Initial

Last Name

Name

Name

Spouse or

First

First

CU Partner

Initial

Name

Name

Last Name

Mailing Address

(Number and Street/

Road or PO Box)

-

Zip

City/Town

State

Code

Location of

A1. VT School

Homestead

District Code

A2. City/Town of Legal Residence on 04/01/2013

State

number, street / road name (Do not use PO Box, “same”, or Town name)

-

-

A3. SPAN Number

(From your 2012/2013 property tax bill)

(REQUIRED)

0 0 %

.

A4. Business Use of Dwelling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A4.

0 0 %

.

A5. Rental Use of Dwelling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A5.

A6. Business or Rental Use of Improvements or Other Buildings

Not including the dwelling, are improvements or other buildings located on your parcel

c

c

used for business or rented? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

A7 - A10 Special Situations (see instructions for more information) . Check the following if it applies:

c

A7. Grantor and sole beneficiary of a revocable trust owning the property .

c

A8. Life estate holder of the property .

c

A9. Homestead property crosses town boundaries . (File a declaration for each town .)

c

A10. Residing in a dwelling owned by a related farmer .

IMPORTANT FILING INFORMATION

•

If you will not be filing a Property Tax Adjustment Claim, please sign the back of this return .

•

If you will be filing a Property Tax Adjustment Claim, continue on to complete Section B .

27

Form HS-122

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2