Form Ct-3-B - Tax-Exempt Domestic International Sales Corporation (Disc) Information Return - 2014 Page 4

ADVERTISEMENT

Page 4 of 6 CT-3-B (2014)

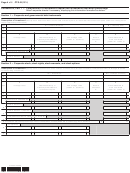

Schedule B, Part 1 — Computation of investment capital and investment allocation percentage

Attach separate sheets if necessary, displaying this information formatted as below.

Section 1 — Corporate and governmental debt instruments

Description of investment

(identify each debt instrument and its date of maturity here; for each debt instrument complete columns C through G on

the corresponding lines below)

A — Debt instrument

Item

B — Maturity date

A

B

C

D

E

F

G

Item

Average value

Liabilities directly or

Net average value

Issuer’s

Value allocated to

indirectly attributable to

allocation

New York State

(column C – column D)

investment capital

%

(column E × column F)

A

B

Amounts from attached list

Totals of Section 1

1

Section 2 — Corporate stock, stock rights, stock warrants, and stock options

Description of investment

(identify each investment and enter number of shares here; for each investment complete columns C through G on the

corresponding lines below)

Item

A — Investment

B — Number of shares

A

B

C

D

E

F

G

Item

Average value

Liabilities directly or

Net average value

Issuer’s

Value allocated to

indirectly attributable to

allocation

New York State

(column C – column D)

investment capital

%

(column E × column F)

A

B

Amounts from attached list

Totals of Section 2

2

Totals of Section 1

(from line 1)

3

Totals

(add lines 2 and 3 in columns C, D, E, and G)

4

5 Investment allocation percentage without the addition of cash

.............

5

%

(divide line 4, column G, by line 4, column E)

Cash

(optional)

6

Investment capital

. Enter column E total on page 2, line 35 of this form.

(add lines 4 and 6 in columns C, D, and E)

7

474004140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6