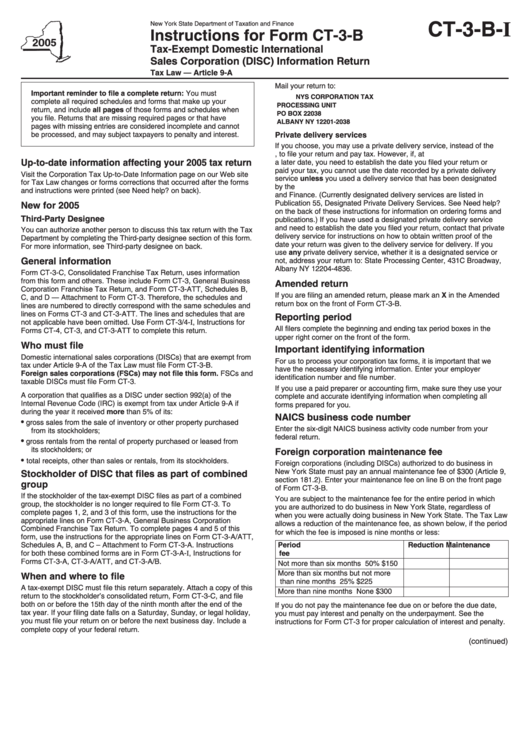

Instructions For Form Ct-3-B - Tax-Exempt Domestic International Sales Corporation (Disc) Information Return - 2005

ADVERTISEMENT

CT-3-B-I

New York State Department of Taxation and Finance

Instructions for Form CT-3-B

Tax-Exempt Domestic International

Sales Corporation (DISC) Information Return

Tax Law — Article 9-A

Mail your return to:

Important reminder to file a complete return: You must

NYS CORPORATION TAX

complete all required schedules and forms that make up your

PROCESSING UNIT

return, and include all pages of those forms and schedules when

PO BOX 22038

you file. Returns that are missing required pages or that have

ALBANY NY 12201-2038

pages with missing entries are considered incomplete and cannot

be processed, and may subject taxpayers to penalty and interest.

Private delivery services

If you choose, you may use a private delivery service, instead of the

U.S. Postal Service, to file your return and pay tax. However, if, at

Up-to-date information affecting your 2005 tax return

a later date, you need to establish the date you filed your return or

paid your tax, you cannot use the date recorded by a private delivery

Visit the Corporation Tax Up-to-Date Information page on our Web site

service unless you used a delivery service that has been designated

for Tax Law changes or forms corrections that occurred after the forms

by the U.S. Secretary of the Treasury or the Commissioner of Taxation

and instructions were printed (see Need help? on back).

and Finance. (Currently designated delivery services are listed in

Publication 55, Designated Private Delivery Services. See Need help?

New for 2005

on the back of these instructions for information on ordering forms and

Third-Party Designee

publications.) If you have used a designated private delivery service

and need to establish the date you filed your return, contact that private

You can authorize another person to discuss this tax return with the Tax

delivery service for instructions on how to obtain written proof of the

Department by completing the Third-party designee section of this form.

date your return was given to the delivery service for delivery. If you

For more information, see Third-party designee on back.

use any private delivery service, whether it is a designated service or

General information

not, address your return to: State Processing Center, 431C Broadway,

Albany NY 12204-4836.

Form CT-3-C, Consolidated Franchise Tax Return, uses information

from this form and others. These include Form CT-3, General Business

Amended return

Corporation Franchise Tax Return, and Form CT-3-ATT, Schedules B,

If you are filing an amended return, please mark an X in the Amended

C, and D — Attachment to Form CT-3. Therefore, the schedules and

return box on the front of Form CT-3-B.

lines are numbered to directly correspond with the same schedules and

lines on Forms CT-3 and CT-3-ATT. The lines and schedules that are

Reporting period

not applicable have been omitted. Use Form CT-3/4-I, Instructions for

All filers complete the beginning and ending tax period boxes in the

Forms CT-4, CT-3, and CT-3-ATT to complete this return.

upper right corner on the front of the form.

Who must file

Important identifying information

Domestic international sales corporations (DISCs) that are exempt from

For us to process your corporation tax forms, it is important that we

tax under Article 9-A of the Tax Law must file Form CT-3-B.

have the necessary identifying information. Enter your employer

Foreign sales corporations (FSCs) may not file this form. FSCs and

identification number and file number.

taxable DISCs must file Form CT-3.

If you use a paid preparer or accounting firm, make sure they use your

A corporation that qualifies as a DISC under section 992(a) of the

complete and accurate identifying information when completing all

Internal Revenue Code (IRC) is exempt from tax under Article 9-A if

forms prepared for you.

during the year it received more than 5% of its:

NAICS business code number

•

gross sales from the sale of inventory or other property purchased

Enter the six-digit NAICS business activity code number from your

from its stockholders;

federal return.

•

gross rentals from the rental of property purchased or leased from

its stockholders; or

Foreign corporation maintenance fee

•

total receipts, other than sales or rentals, from its stockholders.

Foreign corporations (including DISCs) authorized to do business in

New York State must pay an annual maintenance fee of $300 (Article 9,

Stockholder of DISC that files as part of combined

section 181.2). Enter your maintenance fee on line B on the front page

group

of Form CT-3-B.

If the stockholder of the tax-exempt DISC files as part of a combined

You are subject to the maintenance fee for the entire period in which

group, the stockholder is no longer required to file Form CT-3. To

you are authorized to do business in New York State, regardless of

complete pages 1, 2, and 3 of this form, use the instructions for the

when you were actually doing business in New York State. The Tax Law

appropriate lines on Form CT-3-A, General Business Corporation

allows a reduction of the maintenance fee, as shown below, if the period

Combined Franchise Tax Return. To complete pages 4 and 5 of this

for which the fee is imposed is nine months or less:

form, use the instructions for the appropriate lines on Form CT-3-A/ATT,

Period

Reduction

Maintenance

Schedules A, B, and C – Attachment to Form CT-3-A. Instructions

for both these combined forms are in Form CT-3-A-I, Instructions for

fee

Forms CT-3-A, CT-3-A/ATT, and CT-3-A/B.

Not more than six months

50%

$150

More than six months but not more

When and where to file

than nine months

25%

$225

A tax-exempt DISC must file this return separately. Attach a copy of this

More than nine months

None

$300

return to the stockholder’s consolidated return, Form CT-3-C, and file

both on or before the 15th day of the ninth month after the end of the

If you do not pay the maintenance fee due on or before the due date,

tax year. If your filing date falls on a Saturday, Sunday, or legal holiday,

you must pay interest and penalty on the underpayment. See the

you must file your return on or before the next business day. Include a

instructions for Form CT-3 for proper calculation of interest and penalty.

complete copy of your federal return.

(continued)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2