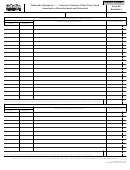

INSTRUCTIONS

WHO MUST FILE. Every person filing the

Nebraska Severance and Conservation Tax Return, Form

61, must

complete this schedule for resources severed from other than school lands. A separate schedule is to be completed

for each Nebraska county in which oil or natural gas is severed from other than school lands. A computer printout

reporting substantially the same information may be submitted in lieu of Nebraska Schedule II, Form 61.

WHEN AND WHERE TO FILE. The return, schedules, and tax payment must be filed every month on or before

the last day of the month following the month in which the resources were severed from the leases. A return must

be filed even if there is no tax due. Schedule II, Form 61, must be mailed to the Nebraska Department of Revenue,

PO Box 94818, Lincoln, NE 68509-4818, with Form 61, and the tax payment. Copies of Schedule II and Form 61

must be mailed to the Nebraska Oil and Gas Conservation Commission, Box 399, Sidney, NE 69162-0399.

COMPUTATIONS. All quantities of oil are to be expressed in standard 42 gallon barrels on the basis of standard

temperature corrections to 60 degrees Fahrenheit and computations made on the basis of tank tables computed to

show 100% of actual capacity and an exact measurement of contents with deduction for full basic sediment and

water (B.S.&W.) content.

All quantities of natural gas are to be expressed in thousand cubic feet (M.C.F.) and computed on the basis of standard

temperature corrections to 60 degrees Fahrenheit at pressure base of 14.73 pounds per square inch (P.S.I.) absolute.

The total quantity and value of oil and natural gas severed are to be calculated net of any oil or natural gas used

in producing or severing operations or for repressuring or recycling purposes.

SPECIFIC INSTRUCTIONS

OGCC LEASE NUMBER. Enter the Nebraska Oil and Gas Conservation Commission (OGCC) lease number for

each oil and natural gas lease reported on Schedule II. The OGCC lease number must be the same lease number

that is reported on the operator’s Nebraska Oil and Gas Conservation Commission Well Status and Monthly

Production Report.

LEASE NAME AND DESCRIPTION. Enter the lease name and description of each oil and natural gas lease

reported on Schedule II. The lease name must be the same lease name as reported on the operator’s Nebraska Oil

and Gas Conservation Commission Well Status and Monthly Production Report.

COLUMNS A AND B. Only specific wells which produced stripper oil as defined below qualify for the reduced

severance tax rate and are to be included in columns A and B. If specific records for each well have not been

maintained, the oil severed is subject to the three percent severance tax rate and is to be included in columns C

and D.

DEFINITIONS.

Base production level shall mean a property’s production for the preceding twelve months divided by the

number of producing well production days. Enhanced recovery injection wells may be counted as producing wells

to determine the base production level for a property.

Stripper oil shall mean oil produced from a property when the base production level is 10 or fewer barrels per day.

Nonstripper oil shall mean oil produced from a property where the base production level is more than 10 barrels

per day.

LINE 2. Enter the total quantities and values in the appropriate columns of the following resources which are

exempt from the computation of the severance and conservation tax:

1. Any interest of the United States, the State of Nebraska, or their political subdivisions in all oil, gas, or

their proceeds;

2. Any interest of a Native American Indian or Native American Indian tribe in oil, gas, or their proceeds

from land subject to U.S. supervision.

1

1 2

2