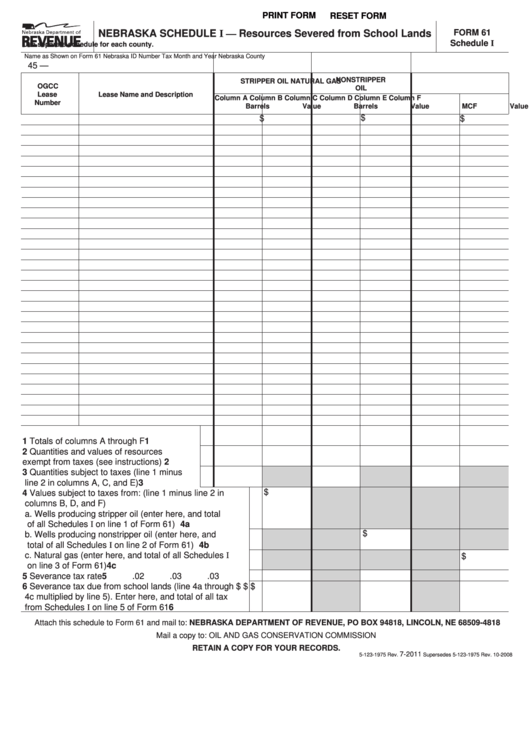

PRINT FORM

RESET FORM

NEBRASKA SCHEDULE I — Resources Severed from School Lands

FORM 61

Schedule I

Use separate schedule for each county.

Name as Shown on Form 61

Nebraska ID Number

Tax Month and Year

Nebraska County

45 —

NONSTRIPPER

STRIPPER OIL

NATURAL GAS

OGCC

OIL

Lease

Lease Name and Description

Column A

Column B

Column C

Column D

Column E

Column F

Number

Barrels

Value

Barrels

Value

MCF

Value

$

$

$

1 Totals of columns A through F ..................

1

2 Quantities and values of resources

exempt from taxes (see instructions)........

2

3 Quantities subject to taxes (line 1 minus

line 2 in columns A, C, and E) ..................

3

$

4 Values subject to taxes from: (line 1 minus line 2 in

columns B, D, and F)

a. Wells producing stripper oil (enter here, and total

of all Schedules I on line 1 of Form 61) ..................... 4a

$

b. Wells producing nonstripper oil (enter here, and

total of all Schedules I on line 2 of Form 61) ............. 4b

c. Natural gas (enter here, and total of all Schedules I

$

on line 3 of Form 61) .................................................. 4c

5 Severance tax rate ......................................................... 5

.02

.03

.03

6 Severance tax due from school lands (line 4a through

$

$

$

4c multiplied by line 5). Enter here, and total of all tax

from Schedules I on line 5 of Form 61 ........................... 6

Attach this schedule to Form 61 and mail to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NE 68509-4818

Mail a copy to: OIL AND GAS CONSERVATION COMMISSION

RETAIN A COPY FOR YOUR RECORDS.

7-2011

5-123-1975 Rev.

Supersedes 5-123-1975 Rev. 10-2008

1

1 2

2