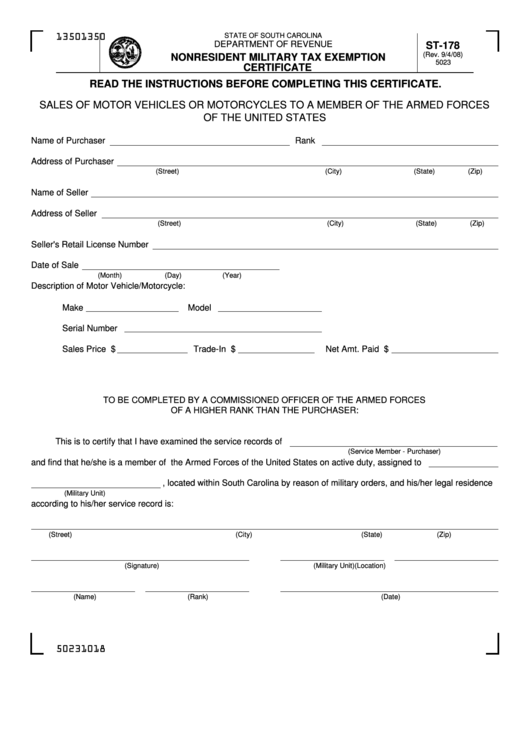

Form St-178 - Nonresident Military Tax Exemption Certificate

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

ST-178

(Rev. 9/4/08)

NONRESIDENT MILITARY TAX EXEMPTION

5023

CERTIFICATE

READ THE INSTRUCTIONS BEFORE COMPLETING THIS CERTIFICATE.

SALES OF MOTOR VEHICLES OR MOTORCYCLES TO A MEMBER OF THE ARMED FORCES

OF THE UNITED STATES

Name of Purchaser

Rank

Address of Purchaser

(Street)

(City)

(State)

(Zip)

Name of Seller

Address of Seller

(Street)

(City)

(State)

(Zip)

Seller's Retail License Number

Date of Sale

(Month)

(Day)

(Year)

Description of Motor Vehicle/Motorcycle:

Make

Model

Serial Number

Sales Price $

Trade-In $

Net Amt. Paid $

TO BE COMPLETED BY A COMMISSIONED OFFICER OF THE ARMED FORCES

OF A HIGHER RANK THAN THE PURCHASER:

This is to certify that I have examined the service records of

(Service Member - Purchaser)

and find that he/she is a member of the Armed Forces of the United States on active duty, assigned to

, located within South Carolina by reason of military orders, and his/her legal residence

(Military Unit)

according to his/her service record is:

(Street)

(City)

(State)

(Zip)

(Signature)

(Military Unit)

(Location)

(Name)

(Rank)

(Date)

50231018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2