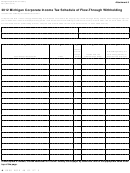

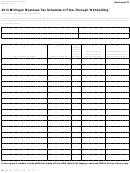

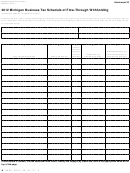

Form 4911 - Michigan Corporate Income Tax Schedule Of Flow-Through Withholding - 2014 Page 3

ADVERTISEMENT

Instructions for Form 4911

Michigan Corporate Income Tax: Schedule of Flow-Through Withholding

Purpose

Column-by-Column Instructions

The purpose of this form is to report the Flow-Through

Name and Account Number: Enter the name and Federal

Withholding (FTW) payments made by a flow-through entity

Employer Identification Number (FEIN) of the taxpayer as

on behalf of a Corporate Income Tax (CIT) filer.

reported on page 1 of the Michigan Corporate Income Tax

Annual Return (Form 4891), Insurance Company Annual

General Instructions

Return for Corporate Income and Retaliatory Taxes (Form

4905), Corporate Income Tax Annual Return for Financial

This form must be used by a taxpayer that is a standard filer,

Institutions (Form 4908), or applicable amended return.

insurance company, financial institution, or unitary business

group (UBG) that has an ownership or beneficial interest in

UBGs: Complete one form for each member of the UBG,

a flow-through entity that has remitted FTW payments to the

if applicable. Enter the FEIN and name of the Designated

state of Michigan on behalf of the taxpayer that is filing this

Member in the Taxpayer Name and FEIN fields and the

form. Reported on this form will be the FTW payments made

member’s name and FEIN to whom the schedule applies on the

by the flow-through entity if that flow-through entity’s tax year

line below.

ended with or within the tax year of the taxpayer filing this

Columns A and B: Identify each flow-through entity that

form.

remitted FTW payments on behalf of the taxpayer filing this

In addition to being required to withhold on the distributive

form by name and FEIN.

share of income received by nonresident individual members,

Column D: Enter the unapportioned distributive share of

a flow-through entity that reasonably expects to have more

taxable income received from the flow-through entity as it

than $200,000 in business income after allocation and

is listed on the notice of withholding provided by the flow-

apportionment in the tax year is also required to withhold on

through entity.

the distributive share of income received by its members that

are C Corporations and other flow-through entities. Financial

Column E: Enter the FTW payments made on behalf of the

taxpayer by the flow-through entity as it is listed on the notice

institutions and insurance companies are not required to

provided to the taxpayer by the flow-through entity. Included

be withheld on. In addition, under PA 233 of 2013, if the

Flow-Through Entity (FTE) has made a valid election to file

on this column would be FTW payments made by flow-through

Michigan Business Tax (MBT), it is not obligated to remit

entities whose tax years ended with or within the tax year of

FTW on behalf of its members. However, if FTW payments

the taxpayer filing this form. For example, a calendar year filer

would include FTW payments made by a flow-through entity

were made on behalf of any CIT taxpayer, it must complete this

form to receive credit for the FTW payments on its CIT return.

whose tax year ended on or after January 1, 2014, and on or

before December 31, 2014. The amount listed here will match

A flow-through entity is an entity that, for the applicable tax

the amount of withholding reported to the taxpayer by the flow-

year, is treated as a subchapter S corporation under section

through entity.

1362(a) of the internal revenue code, a general partnership, a

trust, a limited partnership, a limited liability partnership, or a

The combined amount entered in this column should be entered

on line 46 of Form 4891 if this form is filed by a standard

limited liability company that is not taxed as a C Corporation

taxpayer; line 44 of Form 4905 if this form is filled out by an

for federal income tax purposes.

insurance company; or line 25 of Form 4908 if this form is

filled out by a financial institution.

UBG NOTE: The total of column E for each member should

be carried to Form 4897, line 38, for that member.

FINANCIAL UBG NOTE: The total of column E for each

member should be carried to Form 4910, line 27, for that

member.

93

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3