Form A-5 - Land Use Change Tax

Download a blank fillable Form A-5 - Land Use Change Tax in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form A-5 - Land Use Change Tax with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

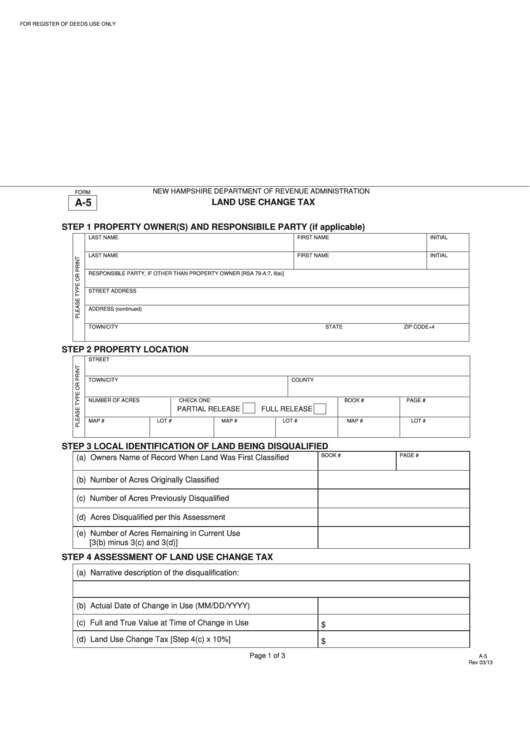

FOR REGISTER OF DEEDS USE ONLY

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

A-5

LAND USE CHANGE TAX

STEP 1 PROPERTY OWNER(S) AND RESPONSIBILE PARTY (if applicable)

LAST NAME

FIRST NAME

INITIAL

LAST NAME

FIRST NAME

INITIAL

RESPONSIBLE PARTY, IF OTHER THAN PROPERTY OWNER [RSA 79-A:7, II(e)]

STREET ADDRESS

ADDRESS (continued)

TOWN/CITY

STATE

ZIP CODE+4

STEP 2 PROPERTY LOCATION

STREET

TOWN/CITY

COUNTY

NUMBER OF ACRES

CHECK ONE:

BOOK #

PAGE #

PARTIAL RELEASE

FULL RELEASE

MAP #

LOT #

MAP #

LOT #

MAP #

LOT #

STEP 3 LOCAL IDENTIFICATION OF LAND BEING DISQUALIFIED

BOOK #

PAGE #

(a) Owners Name of Record When Land Was First Classified

(b) Number of Acres Originally Classified

(c) Number of Acres Previously Disqualified

(d) Acres Disqualified per this Assessment

(e) Number of Acres Remaining in Current Use

[3(b) minus 3(c) and 3(d)]

STEP 4 ASSESSMENT OF LAND USE CHANGE TAX

(a) Narrative description of the disqualification:

(b) Actual Date of Change in Use (MM/DD/YYYY)

(c) Full and True Value at Time of Change in Use

$

(d) Land Use Change Tax [Step 4(c) x 10%]

$

Page 1 of 3

A-5

Rev 03/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3