Rsa 79-A:10 Land Use Change Tax Abatement Application To Municipality

ADVERTISEMENT

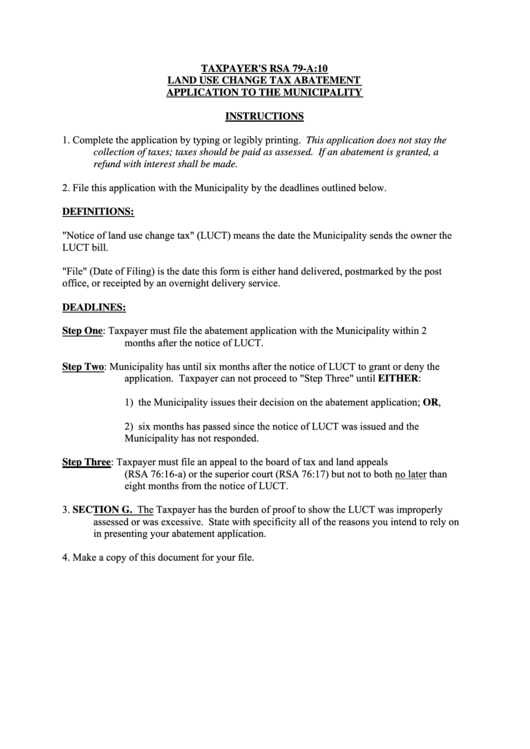

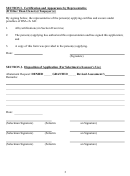

TAXPAYER'S RSA 79-A:10

LAND USE CHANGE TAX ABATEMENT

APPLICATION TO THE MUNICIPALITY

INSTRUCTIONS

1.

Complete the application by typing or legibly printing. This application does not stay the

collection of taxes; taxes should be paid as assessed. If an abatement is granted, a

refund with interest shall be made.

2.

File this application with the Municipality by the deadlines outlined below.

DEFINITIONS:

"Notice of land use change tax" (LUCT) means the date the Municipality sends the owner the

LUCT bill.

"File" (Date of Filing) is the date this form is either hand delivered, postmarked by the post

office, or receipted by an overnight delivery service.

DEADLINES:

Taxpayer must file the abatement application with the Municipality within 2

Step One:

months after the notice of LUCT.

Municipality has until six months after the notice of LUCT to grant or deny the

Step Two:

application. Taxpayer can not proceed to "Step Three" until EITHER:

1) the Municipality issues their decision on the abatement application; OR,

2) six months has passed since the notice of LUCT was issued and the

Municipality has not responded.

Step Three: Taxpayer must file an appeal to the board of tax and land appeals

(RSA 76:16-a) or the superior court (RSA 76:17) but not to both no later than

eight months from the notice of LUCT.

3.

SECTION G. The Taxpayer has the burden of proof to show the LUCT was improperly

assessed or was excessive. State with specificity all of the reasons you intend to rely on

in presenting your abatement application.

4.

Make a copy of this document for your file.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4