Instructions For Form 323 - Arizona Credit For Contributions To Private School Tuition Organizations - 2014

ADVERTISEMENT

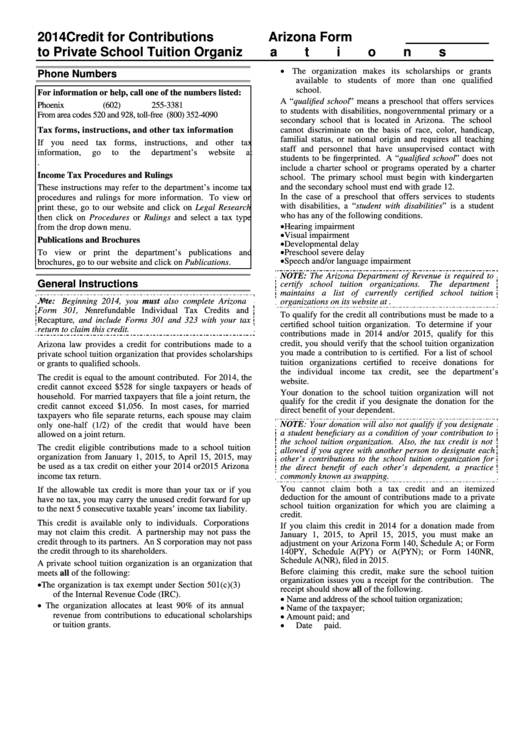

2014Credit for Contributions

Arizona Form

to Private School Tuition Organizations

323

The organization makes its scholarships or grants

Phone Numbers

available to students of more than one qualified

school.

For information or help, call one of the numbers listed:

A “qualified school” means a preschool that offers services

Phoenix

(602) 255-3381

to students with disabilities, nongovernmental primary or a

From area codes 520 and 928, toll-free

(800) 352-4090

secondary school that is located in Arizona. The school

cannot discriminate on the basis of race, color, handicap,

Tax forms, instructions, and other tax information

familial status, or national origin and requires all teaching

If you need tax forms, instructions, and other tax

staff and personnel that have unsupervised contact with

information,

go

to

the

department’s

website

at

students to be fingerprinted. A “qualified school” does not

include a charter school or programs operated by a charter

Income Tax Procedures and Rulings

school. The primary school must begin with kindergarten

and the secondary school must end with grade 12.

These instructions may refer to the department’s income tax

In the case of a preschool that offers services to students

procedures and rulings for more information. To view or

with disabilities, a “student with disabilities” is a student

print these, go to our website and click on Legal Research

who has any of the following conditions.

then click on Procedures or Rulings and select a tax type

Hearing impairment

from the drop down menu.

Visual impairment

Publications and Brochures

Developmental delay

To view or print the department’s publications and

Preschool severe delay

Speech and/or language impairment

brochures, go to our website and click on Publications.

NOTE: The Arizona Department of Revenue is required to

General Instructions

certify school tuition organizations.

The department

maintains a list of currently certified school tuition

Note: Beginning 2014, you must also complete Arizona

organizations on its website at

Form 301, Nonrefundable Individual Tax Credits and

To qualify for the credit all contributions must be made to a

Recapture, and include Forms 301 and 323 with your tax

certified school tuition organization. To determine if your

return to claim this credit.

contributions made in 2014 and/or 2015, qualify for this

credit, you should verify that the school tuition organization

Arizona law provides a credit for contributions made to a

you made a contribution to is certified. For a list of school

private school tuition organization that provides scholarships

tuition organizations certified to receive donations for

or grants to qualified schools.

the individual income tax credit, see the department’s

The credit is equal to the amount contributed. For 2014, the

website.

credit cannot exceed $528 for single taxpayers or heads of

Your donation to the school tuition organization will not

household. For married taxpayers that file a joint return, the

qualify for the credit if you designate the donation for the

credit cannot exceed $1,056. In most cases, for married

direct benefit of your dependent.

taxpayers who file separate returns, each spouse may claim

NOTE: Your donation will also not qualify if you designate

only one-half (1/2) of the credit that would have been

a student beneficiary as a condition of your contribution to

allowed on a joint return.

the school tuition organization. Also, the tax credit is not

The credit eligible contributions made to a school tuition

allowed if you agree with another person to designate each

organization from January 1, 2015, to April 15, 2015, may

other’s contributions to the school tuition organization for

be used as a tax credit on either your 2014 or 2015 Arizona

the direct benefit of each other’s dependent, a practice

income tax return.

commonly known as swapping.

You cannot claim both a tax credit and an itemized

If the allowable tax credit is more than your tax or if you

deduction for the amount of contributions made to a private

have no tax, you may carry the unused credit forward for up

school tuition organization for which you are claiming a

to the next 5 consecutive taxable years’ income tax liability.

credit.

This credit is available only to individuals. Corporations

If you claim this credit in 2014 for a donation made from

may not claim this credit. A partnership may not pass the

January 1, 2015, to April 15, 2015, you must make an

credit through to its partners. An S corporation may not pass

adjustment on your Arizona Form 140, Schedule A; or Form

the credit through to its shareholders.

140PY, Schedule A(PY) or A(PYN); or Form 140NR,

Schedule A(NR), filed in 2015.

A private school tuition organization is an organization that

Before claiming this credit, make sure the school tuition

meets all of the following:

organization issues you a receipt for the contribution. The

The organization is tax exempt under Section 501(c)(3)

receipt should show all of the following.

of the Internal Revenue Code (IRC).

Name and address of the school tuition organization;

The organization allocates at least 90% of its annual

Name of the taxpayer;

revenue from contributions to educational scholarships

Amount paid; and

or tuition grants.

Date paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2