Amended Colorado Oil and gas severance Tax Return

DR 0021X instructions

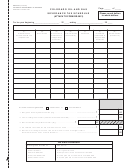

The Amended Colorado Oil and gas severance Tax Return

The routing number must be nine digits. The account number

(DR 0021X) is required to be used when correcting your

can be up to 17 characters (both numbers and letters). Include

Colorado Oil and gas severance Tax Return (DR 0021).

hyphens but omit spaces and special symbols.

You should contact your financial institution to make sure your

statute of Limitations

deposit will be accepted and to obtain the correct routing and

The statute of limitations for filing a Colorado severance tax

account numbers. This is especially important if you want your

claim for refund is generally three years from the due date of the

refund deposited to a savings account at a credit union. The

original return or three years from the date of last tax payment

Department of Revenue is not responsible for a lost refund if

for the year involved, whichever is later.

you enter the wrong account information. Any refund claim that,

Refund for Deceased Taxpayer

for any reason, cannot be deposited into the account specified

To request a refund for a deceased taxpayer, write “deceased”

will be issued and mailed in check form instead.

across the top of the return and the date of death next to the

interest

deceased person’s name. Additionally, you must sign the

If the return is amended after the original due date of the return,

return and write “filling as surviving spouse” or “filling as legal

interest at the applicable statutory rate will accrue on any balance

representative” by your signature.

of tax due until paid.

Any person other than the surviving spouse who files a return

and requires a refund on behalf of a deceased person must

attach a copy of the death certificate and the DR 0102, Claim

January 1 through December 31:

2008 2009 2010 2011 2012

for Refund for Deceased Taxpayer.

Tax due paid without billing

8%

5%

3%

3%

3%

Colorado Account Number

For business accounts, enter your Colorado account number and

Tax paid within 30 days of billing

8%

5%

3%

3%

3%

your Federal Employer Identification Number (FEIN) in the spaces

provided. For individuals, enter your Social Security number.

Tax due paid after 30 days of billing

11%

8%

6%

6%

6%

Lines 11 through 17 compute the amount owed to the state

Refunds of less than $5,000

11%

8%

6%

6%

6%

on the amended return. Any decrease in the amount of the

overpayment (line 11) or increase in the amount owed (line 12)

Refunds of $5,000 or more and 10%

8%

5%

3%

3%

3%

will indicate that an amount is owed with the amended return. To

or more of the net tax liability

pay the amount you owe, write your Colorado account number or

Federal Employer Identification Number (FEIN) on your check.

Penalty

Enclose but do not attach your payment with DR 0020CX

The penalty on any balance of tax due is $30 or 30% of the

balance of tax due, whichever is greater.

Lines 18 through 21 compute the amount of credit available

on the amended return. Any increase in the amount of the

Reason for amended return

overpayment (line 18) or decrease in the amount owed (line 19)

Attach an explanation and any documentation, including schedule

will indicate that an overpayment is available with the amended

DR 0021D, and/or DR 0021pD needed to substantiate the

return. The overpayment can be credited to estimated tax (line

changes reported on the amended return.

21) for the tax year following the period on the amended return,

Forms and information

or can be requested as a refund (line 20).

If you have any questions you may call the Department of

Direct Deposit

Revenue at (303) 238-SERV(7378) or see our Web site at

The department can deposit your refund directly into your account

for forms and information.

at a U.S. bank or other financial institution (such as a mutual

fund, brokerage firm, or credit union) in the United States.

how do i use Direct Deposit?

1

1 2

2