Form Ctp-121 - Certification By Non-Participating Manufacturer Page 2

ADVERTISEMENT

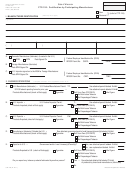

III. MANUFACTURER BUSINESS ORGANIZATION

Legal Name

Certification for Sales Year

A. Organization (check one)

Sole Proprietor

If Governmental Unit, check appropriate box

Federal

County

Tribal

Partnership

Wisconsin Corporation – Enter date incorporated:

State/Provincial Agency

Local

Limited Liability Company – Enter date registered

Out-of-State / Country Corporation – Are you registered to do

with the Secretary of State or equivalent:

business in Wisconsin?

YES

NO

For federal income tax purposes, how will the LLC be taxed:

Other – Describe:

Partnership

Corporation

Single member LLC dis-

regarded as a separate entity

•

List all states in which you are registered with the Secretary of State or equivalent

•

Indicate the state/province/country where your business was formed and attach copies of current articles [or similar such document(s)] and bylaws

labeled as Exhibit

.

B. For the organization marked in “A” above, complete the following for each individual, partner, or member and each officer, director, agent and holder of 5%

or more stock. If additional space is needed, attach additional sheet(s) in the same format as below. (MUST BE COMPLETED.)

Name

Home Address & Phone Number

Percent of

City / Town / Village

State

Country

Zip Code

Position / Title

SS# / Date of Birth

(including international & area code)

Stock Held

*

Identify by (

) any person in B. above who: a) has an ownership interest or holds a management position in your firm; and

(b) within the past five years has had an affiliation with, been employed or otherwise compensated by, a tobacco product

manufacturer, distributor, importer or other such business involved with the sale or purchase of tobacco products. For each person

that has such a relationship, identify the particular tobacco company with which the person is associated. Attach this list labeled as “Exhibit

”.

C. Enter the name(s) and dates below under which you have conducted business in the past five (5) years involved with the sale or purchase of tobacco

products. If additional space is needed, attach additional sheet(s) in the same format as below.

Legal Name

Doing Business As (DBA)

Date of Change

I certify, under penalty of perjury, that all of the information contained in this Certification Form (CTP‑120/CTP‑121) and all related schedules (CTP‑122,

CTP‑122a, CTP‑122b, CTP‑122c and CTP‑123, CTP‑123a, CTP‑123b, CTP‑123c and CTP‑124 or CTP‑126) and all supporting documentation is true, ac‑

curate, and complete. I further certify that the above named Manufacturer is in full compliance with Wisconsin Statutes ss. 995.10, 995.12, and Wisconsin

Chapter 139 and all related Codes and all rules adopted pursuant to those chapters. The signature on this Certification Form must be notarized by an

authorized notary public.

Name of Owner, Officer, Partner or Director of Manufacturer and title (please print or type)

Signature of Owner, Officer, Partner or Director of Manufacturer

Date

Signature of Notary Public

Subscribed and sworn to before me on this date

(seal)

City or County of

My Commission Expires on

Mail this Certification Form to the Attorney General:

Any change or modification should also be mailed to:

Tobacco Enforcement Coordinator

Excise Tax Section 6-107

Wisconsin Department of Justice

Wisconsin Department of Revenue

PO Box 7857

PO Box 8900

Madison WI 53707-7857

Madison WI 53708-8900

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2