Form Pt-102.2 - Diesel Motor Fuel Nontaxable Sales Page 2

ADVERTISEMENT

Page 2 of 3 PT-102.2 (1/14)

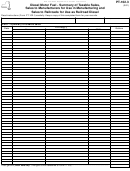

Part 2 — Sales of non-highway diesel motor fuel to exempt organizations

(list sales, except sales for residential heating/cooling, to exempt organizations qualified under Tax Law

sections 1116(a)(4) or 1116(a)(5); this exemption is for sales of non-highway diesel motor fuel only)

Date

Mode of

Carrier’s name

Purchaser’s name

Origin

Destination

Exempt

Gallons

Product

shipped

delivery

and EIN

and EIN

terminal control

terminal control

organization

code*

number or

number or

number

(city, state)

(city, state)

Total gallons

(enter here and on Form PT-102, line 11)

..........................................................................................................................................................................

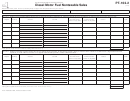

Part 3 — Exempt sales on Indian reservations

(include sales to exempt Indian nations or tribes and qualified Indian consumers; see instructions)

Date

Mode of

Carrier’s name

Purchaser’s name

Origin

Destination

Manifest

Gallons

Product

shipped

delivery

and EIN

and EIN

terminal control

terminal control

number

code*

number or

number or

(city, state)

(city, state)

Total gallons

..........................................................................................................................................................................

(enter here and on Form PT-102, line 21)

*From Publication 902, Product Codes for Fuels.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3