Reset This Form

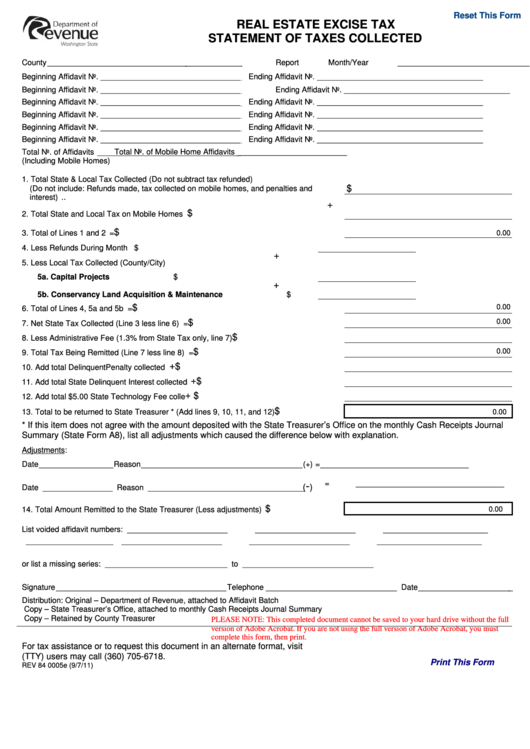

REAL ESTATE EXCISE TAX

STATEMENT OF TAXES COLLECTED

County ______________________________________________

Report Month/Year ______________________________________

Beginning Affidavit No. _________________________________

Ending Affidavit No. ______________________________________

Beginning Affidavit No. _________________________________

Ending Affidavit No. ______________________________________

Beginning Affidavit No. _________________________________

Ending Affidavit No. ______________________________________

Beginning Affidavit No. _________________________________

Ending Affidavit No. ______________________________________

Beginning Affidavit No. _________________________________

Ending Affidavit No. ______________________________________

Beginning Affidavit No. _________________________________

Ending Affidavit No. ______________________________________

Total No. of Affidavits __________________________________

Total No. of Mobile Home Affidavits _________________________

(Including Mobile Homes)

1. Total State & Local Tax Collected (Do not subtract tax refunded)

(Do not include: Refunds made, tax collected on mobile homes, and penalties and

$

interest) .......................................................................................................................

+

$

2. Total State and Local Tax on Mobile Homes ..............................................................

$

3. Total of Lines 1 and 2 .................................................................................................

=

0.00

4. Less Refunds During Month .................................................

$

+

5. Less Local Tax Collected (County/City)

5a. Capital Projects ..........................................................

$

+

5b. Conservancy Land Acquisition & Maintenance .......

$

0.00

$

6. Total of Lines 4, 5a and 5b .........................................................................................

=

$

0.00

7. Net State Tax Collected (Line 3 less line 6) ................................................................

=

$

8. Less Administrative Fee (1.3% from State Tax only, line 7) .....................................

-

$

0.00

9. Total Tax Being Remitted (Line 7 less line 8) .............................................................

=

+

$

10. Add total Delinquent Penalty collected .....................................................................

+

$

11. Add total State Delinquent Interest collected ............................................................

+

$

12. Add total $5.00 State Technology Fee collected.......................................................

$

0.00

13. Total to be returned to State Treasurer * (Add lines 9, 10, 11, and 12) ....................

* If this item does not agree with the amount deposited with the State Treasurer’s Office on the monthly Cash Receipts Journal

Summary (State Form A8), list all adjustments which caused the difference below with explanation.

Adjustments:

Date _________________ Reason _____________________________________ (+)

= __________________________________

= __________________________________

-

(

)

Date ________________ Reason ____________________________________

$

0.00

14. Total Amount Remitted to the State Treasurer (Less adjustments) ..........................

List voided affidavit numbers:

_______________________

_______________________

________________________

____________________

_______________________

_______________________

________________________

or list a missing series: ____________________________ to ______________________________

Signature _______________________________________ Telephone ______________________________ Date ______________________

Distribution:

Original – Department of Revenue, attached to Affidavit Batch

Copy – State Treasurer’s Office, attached to monthly Cash Receipts Journal Summary

Copy – Retained by County Treasurer

PLEASE NOTE: This completed document cannot be saved to your hard drive without the full

version of Adobe Acrobat. If you are not using the full version of Adobe Acrobat, you must

complete this form, then print.

For tax assistance or to request this document in an alternate format, visit or call 1-800-647-7706. Teletype

(TTY) users may call (360) 705-6718.

Print This Form

REV 84 0005e (9/7/11)

1

1