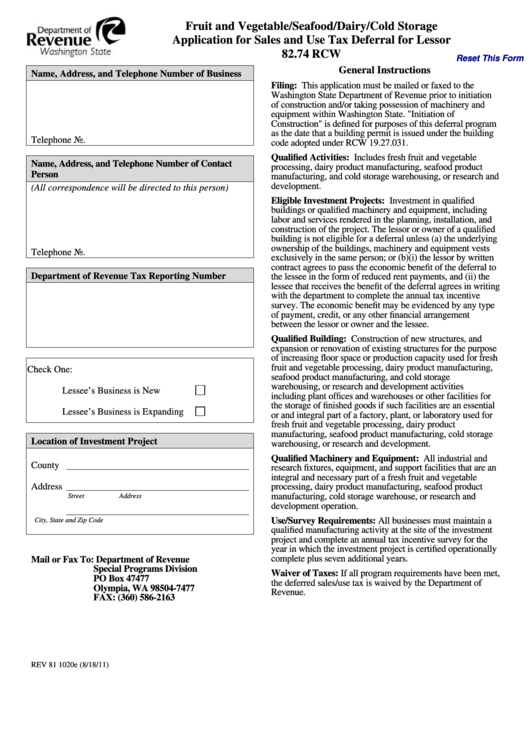

Fruit and Vegetable/Seafood/Dairy/Cold Storage

Application for Sales and Use Tax Deferral for Lessor

82.74 RCW

Reset This Form

General Instructions

Name, Address, and Telephone Number of Business

Filing: This application must be mailed or faxed to the

Washington State Department of Revenue prior to initiation

of construction and/or taking possession of machinery and

equipment within Washington State. "Initiation of

Construction" is defined for purposes of this deferral program

as the date that a building permit is issued under the building

Telephone No.

code adopted under RCW 19.27.031.

Qualified Activities: Includes fresh fruit and vegetable

Name, Address, and Telephone Number of Contact

processing, dairy product manufacturing, seafood product

Person

manufacturing, and cold storage warehousing, or research and

development.

(All correspondence will be directed to this person)

Eligible Investment Projects: Investment in qualified

buildings or qualified machinery and equipment, including

labor and services rendered in the planning, installation, and

construction of the project. The lessor or owner of a qualified

building is not eligible for a deferral unless (a) the underlying

ownership of the buildings, machinery and equipment vests

Telephone No.

exclusively in the same person; or (b)(i) the lessor by written

contract agrees to pass the economic benefit of the deferral to

Department of Revenue Tax Reporting Number

the lessee in the form of reduced rent payments, and (ii) the

lessee that receives the benefit of the deferral agrees in writing

with the department to complete the annual tax incentive

survey. The economic benefit may be evidenced by any type

of payment, credit, or any other financial arrangement

between the lessor or owner and the lessee.

Qualified Building: Construction of new structures, and

expansion or renovation of existing structures for the purpose

of increasing floor space or production capacity used for fresh

fruit and vegetable processing, dairy product manufacturing,

Check One:

seafood product manufacturing, and cold storage

warehousing, or research and development activities

Lessee’s Business is New

including plant offices and warehouses or other facilities for

the storage of finished goods if such facilities are an essential

Lessee’s Business is Expanding

or and integral part of a factory, plant, or laboratory used for

fresh fruit and vegetable processing, dairy product

manufacturing, seafood product manufacturing, cold storage

Location of Investment Project

warehousing, or research and development.

Qualified Machinery and Equipment: All industrial and

County

research fixtures, equipment, and support facilities that are an

integral and necessary part of a fresh fruit and vegetable

Address

processing, dairy product manufacturing, seafood product

Street Address

manufacturing, cold storage warehouse, or research and

development operation.

City, State and Zip Code

Use/Survey Requirements: All businesses must maintain a

qualified manufacturing activity at the site of the investment

project and complete an annual tax incentive survey for the

year in which the investment project is certified operationally

complete plus seven additional years.

Mail or Fax To: Department of Revenue

Special Programs Division

Waiver of Taxes: If all program requirements have been met,

PO Box 47477

the deferred sales/use tax is waived by the Department of

Olympia, WA 98504-7477

Revenue.

FAX: (360) 586-2163

REV 81 1020e (8/18/11)

1

1 2

2 3

3