Request For Tax Status Page 2

Download a blank fillable Request For Tax Status in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Request For Tax Status with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

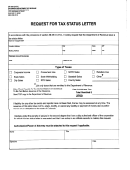

REQUEST FOR TAX STATUS

Request for tax status letters must be in writing.

There is no charge for tax status letters.

Request must include the following information:

• Tax reporting account number

• Name of business

• Phone number for questions.

• Address to mail letter

• Fax number if the taxpayer requests the completed letter to be faxed.

For the Department of Revenue to release tax status information, the request must have an

authorizing signature from the taxpayer as follows:

Sole Proprietor – Signature must be from the sole proprietor.

Partnership – Signature must be from any one of the partners.

Corporation – Signature must be from one of the corporate officers such as:

• President

• Vice President

• Treasurer

The name and title should be typed or printed under the authorized signature.

For tax status letters to be sent to someone other than the taxpayer, the following information

must be included:

• Contact Name

• Business

• Address

• Phone Number

• Fax Number

Requests can be faxed or mailed to the following address:

Tax Status Desk

Department of Revenue

Taxpayer Account Administration

PO Box 47476

Olympia, WA 98504-7476

Fax: (360) 586-0527

REV 42 2443e (12/4/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2