Instructions For Form 342 - Arizona Credit For Renewable Energy Industry - 2014

ADVERTISEMENT

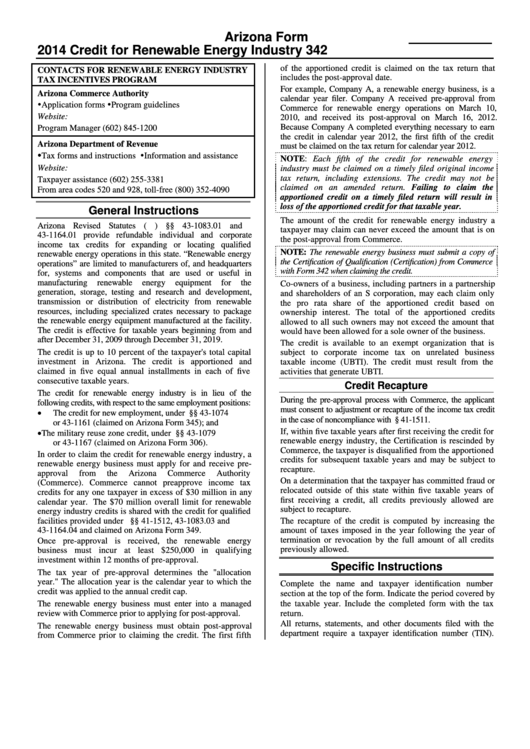

Arizona Form

2014 Credit for Renewable Energy Industry

342

of the apportioned credit is claimed on the tax return that

CONTACTS FOR RENEWABLE ENERGY INDUSTRY

includes the post-approval date.

TAX INCENTIVES PROGRAM

For example, Company A, a renewable energy business, is a

Arizona Commerce Authority

calendar year filer. Company A received pre-approval from

Application forms Program guidelines

Commerce for renewable energy operations on March 10,

Website:

2010, and received its post-approval on March 16, 2012.

Because Company A completed everything necessary to earn

Program Manager

(602) 845-1200

the credit in calendar year 2012, the first fifth of the credit

Arizona Department of Revenue

must be claimed on the tax return for calendar year 2012.

Tax forms and instructions Information and assistance

NOTE: Each fifth of the credit for renewable energy

Website:

industry must be claimed on a timely filed original income

tax return, including extensions. The credit may not be

Taxpayer assistance

(602) 255-3381

claimed on an amended return. Failing to claim the

From area codes 520 and 928, toll-free

(800) 352-4090

apportioned credit on a timely filed return will result in

loss of the apportioned credit for that taxable year.

General Instructions

The amount of the credit for renewable energy industry a

Arizona Revised Statutes (A.R.S.) §§ 43-1083.01 and

taxpayer may claim can never exceed the amount that is on

43-1164.01 provide refundable individual and corporate

the post-approval from Commerce.

income tax credits for expanding or locating qualified

NOTE: The renewable energy business must submit a copy of

renewable energy operations in this state. “Renewable energy

the Certification of Qualification (Certification) from Commerce

operations” are limited to manufacturers of, and headquarters

with Form 342 when claiming the credit.

for, systems and components that are used or useful in

manufacturing

renewable

energy

equipment

for

the

Co-owners of a business, including partners in a partnership

generation, storage, testing and research and development,

and shareholders of an S corporation, may each claim only

transmission or distribution of electricity from renewable

the pro rata share of the apportioned credit based on

resources, including specialized crates necessary to package

ownership interest. The total of the apportioned credits

the renewable energy equipment manufactured at the facility.

allowed to all such owners may not exceed the amount that

The credit is effective for taxable years beginning from and

would have been allowed for a sole owner of the business.

after December 31, 2009 through December 31, 2019.

The credit is available to an exempt organization that is

The credit is up to 10 percent of the taxpayer's total capital

subject to corporate income tax on unrelated business

investment in Arizona. The credit is apportioned and

taxable income (UBTI). The credit must result from the

claimed in five equal annual installments in each of five

activities that generate UBTI.

consecutive taxable years.

Credit Recapture

The credit for renewable energy industry is in lieu of the

During the pre-approval process with Commerce, the applicant

following credits, with respect to the same employment positions:

must consent to adjustment or recapture of the income tax credit

The credit for new employment, under A.R.S. §§ 43-1074

in the case of noncompliance with A.R.S. § 41-1511.

or 43-1161 (claimed on Arizona Form 345); and

If, within five taxable years after first receiving the credit for

The military reuse zone credit, under A.R.S. §§ 43-1079

renewable energy industry, the Certification is rescinded by

or 43-1167 (claimed on Arizona Form 306).

Commerce, the taxpayer is disqualified from the apportioned

In order to claim the credit for renewable energy industry, a

credits for subsequent taxable years and may be subject to

renewable energy business must apply for and receive pre-

recapture.

approval

from

the

Arizona

Commerce

Authority

On a determination that the taxpayer has committed fraud or

(Commerce). Commerce cannot preapprove income tax

relocated outside of this state within five taxable years of

credits for any one taxpayer in excess of $30 million in any

first receiving a credit, all credits previously allowed are

calendar year. The $70 million overall limit for renewable

subject to recapture.

energy industry credits is shared with the credit for qualified

facilities provided under A.R.S. §§ 41-1512, 43-1083.03 and

The recapture of the credit is computed by increasing the

43-1164.04 and claimed on Arizona Form 349.

amount of taxes imposed in the year following the year of

termination or revocation by the full amount of all credits

Once pre-approval is received, the renewable energy

previously allowed.

business must incur at least $250,000 in qualifying

investment within 12 months of pre-approval.

Specific Instructions

The tax year of pre-approval determines the "allocation

year." The allocation year is the calendar year to which the

Complete the name and taxpayer identification number

credit was applied to the annual credit cap.

section at the top of the form. Indicate the period covered by

the taxable year. Include the completed form with the tax

The renewable energy business must enter into a managed

review with Commerce prior to applying for post-approval.

return.

All returns, statements, and other documents filed with the

The renewable energy business must obtain post-approval

department require a taxpayer identification number (TIN).

from Commerce prior to claiming the credit. The first fifth

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2