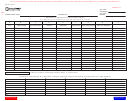

Line 5a

Enter the total intangible expenses or cost paid to each foreign affiliated entity covered by tax treaty by adding

Part II, Lines 1a - 4a. Carry total to Part I, Line 7a.

Line 5b

Enter the total related interest expense or cost paid to each foreign affiliated entity covered by tax treaty by adding

Part II, Lines 1b - 4b. Carry total to Part I, Line 7b.

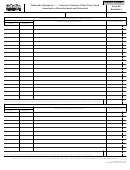

PART III. Transactions with Unaffiliated Entities

Part III is for providing intangible expenses or cost or related interest excluded by reason that the affiliated entity that

received the payment had directly or indirectly paid, accrued or incurred payment to an unaffiliated entity. The payment

to the unaffiliated entity is paid, accrued or incurred on the intangible expense or cost or related interest, and is equal

to or less than the taxpayer's proportional share of the transaction. The taxpayer's proportional share shall be based

on relative sales, assets, liabilities or another reasonable method.

This form allows for the listing of up to five transactions with five affiliated entities. In the event that the taxpayer has

more than five transactions with five affiliated entities, in any combination, a photocopy of this schedule should be used.

Unaffiliated Entity Name and Affiliated Entity FEIN

Enter the name of the unaffiliated entity or outside party that received the related interest or intangible expenses or

cost from the affiliated entity (conduit). Enter the FEIN of the affiliated entity, from Part I, that was the conduit.

Line a

Enter the amount of intangible expenses or cost paid to the unaffiliated entity. The amount paid should be equal to or

less than the taxpayer’s proportional share of the transaction.

Line b

Enter the amount of related interest expense or cost paid to the unaffiliated entity. The amount paid should be equal

to or less than the taxpayer’s proportional share of the transaction.

Line c/d

It is possible that the conduit or affiliated entity charged the taxpayer a mark-up for the transaction, and that the

conduit/affiliated entity may have been a conduit for other transactions between other entities affiliated with the

taxpayer and the outside party. The amount of intangible expenses or cost or related interest that went from the

affiliated entity to the outside party may be greater than the actual amount of intangible expenses or cost or related

interest transacted by the taxpayer for the outside party.

The amount of exception cannot exceed the actual amount paid to the outside party for the taxpayer’s use of the

intangible property. All mark-ups to the conduit/affiliated entity must be excluded, and all amounts for transactions

from other affiliated entities must be excluded. In the event that the amount(s) between the taxpayer and outside

party were not segregated from the mark-ups and other transactions, the exception shall be computed using a ratio

or percentage based on the relative sales/receipts for the intangible expenses or cost or related interest, or assets, or

liabilities or another reasonable method. The taxpayer should indicate on this form if the actual segregated amount(s)

were used, or pro-rations using receipts, assets, liabilities or another reasonable method were used, and attach a

schedule showing the computations.

Enter the percentage used to allocate the portion of the total payments that are related specifically to the use of the

intangible property by the taxpayer, exclusive of any markups by the conduit/affiliated entity. Attach a statement

describing the computation used to calculate the exclusion percentage.

Line e

Enter the exclusion amount for intangible expenses or cost by multiplying Line a by Line c.

Line f

Enter the exclusion amount for related interest expense or cost by multiplying Line b by Line d.

Line 6a

Enter the total intangible expenses or cost excluded by adding Part III, Lines 1e - 5e. Carry total to Part I, Line 8a.

Line 6b

Enter the total related interest expense or cost excluded by adding Part III, Lines 1f - 5f. Carry total to Part I, Line 8b.

REV-802

3

PREVIOUS PAGE

PRINT

Reset Entire Form

1

1 2

2 3

3 4

4 5

5