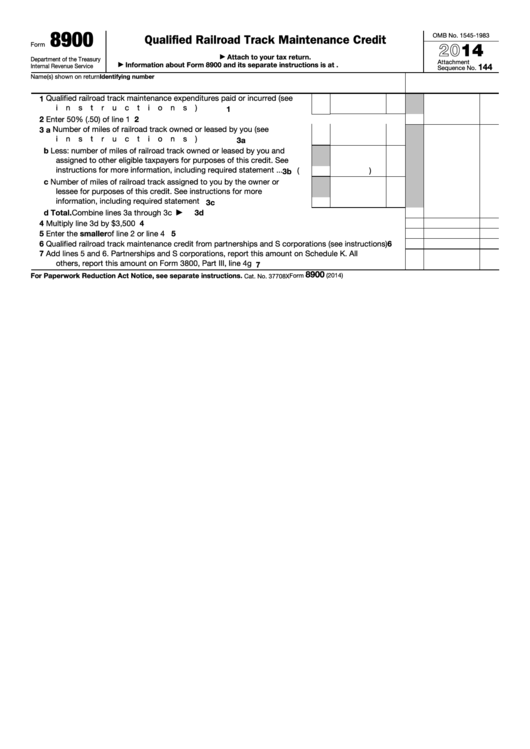

8900

OMB No. 1545-1983

Qualified Railroad Track Maintenance Credit

2014

Form

Attach to your tax return.

▶

Department of the Treasury

Attachment

Information about Form 8900 and its separate instructions is at

144

Internal Revenue Service

▶

Sequence No.

Name(s) shown on return

Identifying number

Qualified railroad track maintenance expenditures paid or incurred (see

1

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

2

Enter 50% (.50) of line 1 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3 a Number of miles of railroad track owned or leased by you (see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3a

b Less: number of miles of railroad track owned or leased by you and

assigned to other eligible taxpayers for purposes of this credit. See

instructions for more information, including required statement .

.

.

3b (

)

c Number of miles of railroad track assigned to you by the owner or

lessee for purposes of this credit. See instructions for more

information, including required statement

.

.

.

.

.

.

.

.

.

3c

d Total. Combine lines 3a through 3c .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3d

▶

4

4

Multiply line 3d by $3,500

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Enter the smaller of line 2 or line 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Qualified railroad track maintenance credit from partnerships and S corporations (see instructions)

6

7

Add lines 5 and 6. Partnerships and S corporations, report this amount on Schedule K. All

others, report this amount on Form 3800, Part III, line 4g

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8900

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2014)

Cat. No. 37708X

1

1