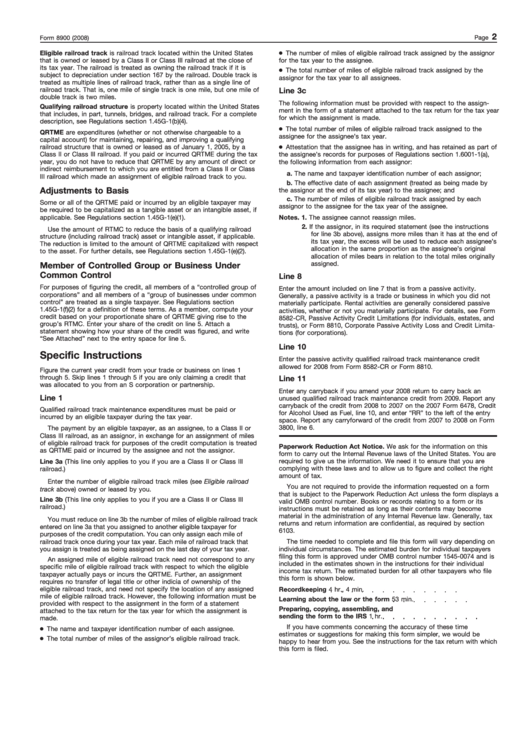

Instructions For Form 8900 - Qualified Railroad Track Maintenance Credit - Department Of Treasury

ADVERTISEMENT

2

Form 8900 (2008)

Page

Eligible railroad track is railroad track located within the United States

The number of miles of eligible railroad track assigned by the assignor

that is owned or leased by a Class II or Class III railroad at the close of

for the tax year to the assignee.

its tax year. The railroad is treated as owning the railroad track if it is

The total number of miles of eligible railroad track assigned by the

subject to depreciation under section 167 by the railroad. Double track is

assignor for the tax year to all assignees.

treated as multiple lines of railroad track, rather than as a single line of

railroad track. That is, one mile of single track is one mile, but one mile of

Line 3c

double track is two miles.

The following information must be provided with respect to the assign-

Qualifying railroad structure is property located within the United States

ment in the form of a statement attached to the tax return for the tax year

that includes, in part, tunnels, bridges, and railroad track. For a complete

for which the assignment is made.

description, see Regulations section 1.45G-1(b)(4).

The total number of miles of eligible railroad track assigned to the

QRTME are expenditures (whether or not otherwise chargeable to a

assignee for the assignee’s tax year.

capital account) for maintaining, repairing, and improving a qualifying

railroad structure that is owned or leased as of January 1, 2005, by a

Attestation that the assignee has in writing, and has retained as part of

Class II or Class III railroad. If you paid or incurred QRTME during the tax

the assignee’s records for purposes of Regulations section 1.6001-1(a),

year, you do not have to reduce that QRTME by any amount of direct or

the following information from each assignor:

indirect reimbursement to which you are entitled from a Class II or Class

a. The name and taxpayer identification number of each assignor;

III railroad which made an assignment of eligible railroad track to you.

b. The effective date of each assignment (treated as being made by

Adjustments to Basis

the assignor at the end of its tax year) to the assignee; and

c. The number of miles of eligible railroad track assigned by each

Some or all of the QRTME paid or incurred by an eligible taxpayer may

assignor to the assignee for the tax year of the assignee.

be required to be capitalized as a tangible asset or an intangible asset, if

applicable. See Regulations section 1.45G-1(e)(1).

Notes. 1. The assignee cannot reassign miles.

2. If the assignor, in its required statement (see the instructions

Use the amount of RTMC to reduce the basis of a qualifying railroad

for line 3b above), assigns more miles than it has at the end of

structure (including railroad track) asset or intangible asset, if applicable.

its tax year, the excess will be used to reduce each assignee’s

The reduction is limited to the amount of QRTME capitalized with respect

allocation in the same proportion as the assignee’s original

to the asset. For further details, see Regulations section 1.45G-1(e)(2).

allocation of miles bears in relation to the total miles originally

assigned.

Member of Controlled Group or Business Under

Common Control

Line 8

For purposes of figuring the credit, all members of a “controlled group of

Enter the amount included on line 7 that is from a passive activity.

corporations” and all members of a “group of businesses under common

Generally, a passive activity is a trade or business in which you did not

control” are treated as a single taxpayer. See Regulations section

materially participate. Rental activities are generally considered passive

1.45G-1(f)(2) for a definition of these terms. As a member, compute your

activities, whether or not you materially participate. For details, see Form

credit based on your proportionate share of QRTME giving rise to the

8582-CR, Passive Activity Credit Limitations (for individuals, estates, and

group’s RTMC. Enter your share of the credit on line 5. Attach a

trusts), or Form 8810, Corporate Passive Activity Loss and Credit Limita-

statement showing how your share of the credit was figured, and write

tions (for corporations).

“See Attached” next to the entry space for line 5.

Line 10

Specific Instructions

Enter the passive activity qualified railroad track maintenance credit

allowed for 2008 from Form 8582-CR or Form 8810.

Figure the current year credit from your trade or business on lines 1

through 5. Skip lines 1 through 5 if you are only claiming a credit that

Line 11

was allocated to you from an S corporation or partnership.

Enter any carryback if you amend your 2008 return to carry back an

Line 1

unused qualified railroad track maintenance credit from 2009. Report any

carryback of the credit from 2008 to 2007 on the 2007 Form 6478, Credit

Qualified railroad track maintenance expenditures must be paid or

for Alcohol Used as Fuel, line 10, and enter “RR” to the left of the entry

incurred by an eligible taxpayer during the tax year.

space. Report any carryforward of the credit from 2007 to 2008 on Form

3800, line 6.

The payment by an eligible taxpayer, as an assignee, to a Class II or

Class III railroad, as an assignor, in exchange for an assignment of miles

of eligible railroad track for purposes of the credit computation is treated

Paperwork Reduction Act Notice. We ask for the information on this

as QRTME paid or incurred by the assignee and not the assignor.

form to carry out the Internal Revenue laws of the United States. You are

required to give us the information. We need it to ensure that you are

Line 3a (This line only applies to you if you are a Class II or Class III

complying with these laws and to allow us to figure and collect the right

railroad.)

amount of tax.

Enter the number of eligible railroad track miles (see Eligible railroad

You are not required to provide the information requested on a form

track above) owned or leased by you.

that is subject to the Paperwork Reduction Act unless the form displays a

Line 3b (This line only applies to you if you are a Class II or Class III

valid OMB control number. Books or records relating to a form or its

railroad.)

instructions must be retained as long as their contents may become

material in the administration of any Internal Revenue law. Generally, tax

You must reduce on line 3b the number of miles of eligible railroad track

returns and return information are confidential, as required by section

entered on line 3a that you assigned to another eligible taxpayer for

6103.

purposes of the credit computation. You can only assign each mile of

railroad track once during your tax year. Each mile of railroad track that

The time needed to complete and file this form will vary depending on

you assign is treated as being assigned on the last day of your tax year.

individual circumstances. The estimated burden for individual taxpayers

filing this form is approved under OMB control number 1545-0074 and is

An assigned mile of eligible railroad track need not correspond to any

included in the estimates shown in the instructions for their individual

specific mile of eligible railroad track with respect to which the eligible

income tax return. The estimated burden for all other taxpayers who file

taxpayer actually pays or incurs the QRTME. Further, an assignment

this form is shown below.

requires no transfer of legal title or other indicia of ownership of the

eligible railroad track, and need not specify the location of any assigned

Recordkeeping

4 hr., 4 min.

mile of eligible railroad track. However, the following information must be

Learning about the law or the form

53 min.

provided with respect to the assignment in the form of a statement

Preparing, copying, assembling, and

attached to the tax return for the tax year for which the assignment is

sending the form to the IRS

1 hr.

made.

If you have comments concerning the accuracy of these time

The name and taxpayer identification number of each assignee.

estimates or suggestions for making this form simpler, we would be

The total number of miles of the assignor’s eligible railroad track.

happy to hear from you. See the instructions for the tax return with which

this form is filed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1