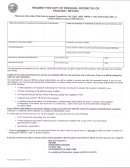

STATE OF CALIFORNIA

REQUEST FOR COPY OF CORPORATION, EXEMPT

DATA STORAGE

ORGANIZATION, PARTNERSHIP, OR LIMITED

FRANCHISE TAX BOARD

LIABILITY COMPANY RETURN

PO BOX 1570

RANCHO CORDOVA CA 95741-1570

Please see other side of this form to request Personal Income Tax (540, 540A, 540EZ, 540NR, or Fiduciary [541]) Returns.

Requester’s Name

Business/Corporation’s Name (as shown on return)

Requester’s Mailing Address

Business/Corporation’s Address (as shown on return)

Tax Return Requested

Taxable Years or

Corporation Number

Federal Employer

(check box below)

Fiscal Year End Date

Identification Number

100 – Corporation Return

100W – California Franchise or

Income Tax Water’s-Edge

Corporation Return

100WE – Water’s Edge

Corporation Return

100S – S Corporation Return

109 – Exempt Organization

Business Income Tax Return

199 – Exempt Organization

Annual Information Return

565 – Partnership Return

568 – Limited Liability

California Secretary of State

Company Return

Number

Signature and Title of Officer or Trustee (Authorized Representative or

Type or Print Name

signature of the person who signed the tax return)

Daytime Telephone Number

Date

If a paid preparer completed your tax returns, get a copy from the preparer to save you both time and money.

Copies of corporation, exempt organization, and limited liability company tax returns are only available for the last five years.

Partnership returns are retained for three and a half years from the original date the return was filed. There is a $20.00 charge

for each tax year requested.

A current authorized representative of the taxpayer must sign this request and provide the business title. Without proper

authorization, we cannot provide the requested copies. Proper authorization includes:

• Any person designated by action of its board of directors, or other similar governing body, upon submission of satisfactory

evidence of such action.

• Any officer or employee of the corporation with a written request signed by any principal officer under the corporate seal, if any.

• A Power of Attorney.

• A letter of testamentary that appoints you as executor.

• A letter of administration that appoints you as administrator.

• A letter of conservatorship that appoints you as conservator.

• A court document that appoints you as trustee.

If a suspended corporation is involved, any amounts owed must be paid before we can send you the requested information. To

determine the amount owed, please call one of the following numbers: from within the United States, 800.852.5711; from outside the

United States (not toll-free), 916.845.6500; or for the hearing or speech impaired 800.822.6268.

If a bankruptcy is involved and you are not the taxpayer, you must also provide one of the following:

• A court document appointing you as trustee.

• A letter signed by the trustee authorizing you to receive this material and a copy of the court documents appointing the trustee.

Send a check or money order payable to the Franchise Tax Board for $20.00 to the address above for each tax year you

request. If the tax return was for a tax year in which you were a victim of a designated California state or federal disaster, then

there is no charge for a copy of your tax return. For additional information, call 916.845.5116 (not toll free).

FTB 3516

(REV 11-2008) SIDE 2 – CORP

C1

1

1 2

2