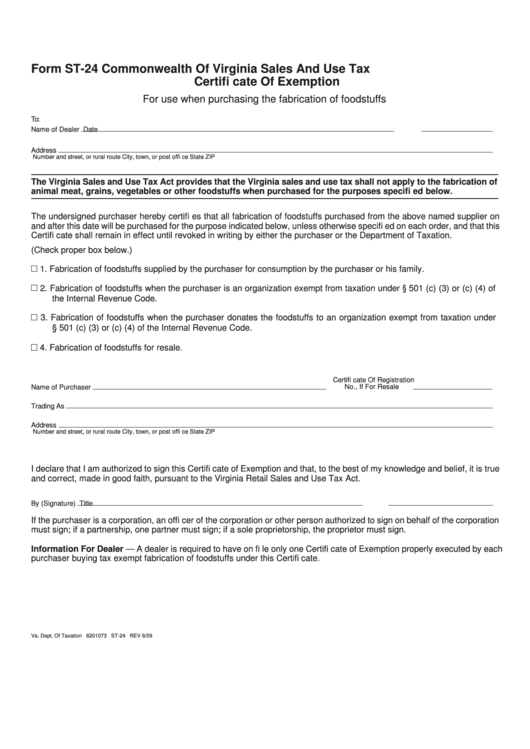

Form ST-24

Commonwealth Of Virginia Sales And Use Tax

Certifi cate Of Exemption

For use when purchasing the fabrication of foodstuffs

To:

Name of Dealer

Date

Address

Number and street, or rural route

City, town, or post offi ce

State

ZIP

The Virginia Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to the fabrication of

animal meat, grains, vegetables or other foodstuffs when purchased for the purposes specifi ed below.

The undersigned purchaser hereby certifi es that all fabrication of foodstuffs purchased from the above named supplier on

and after this date will be purchased for the purpose indicated below, unless otherwise specifi ed on each order, and that this

Certifi cate shall remain in effect until revoked in writing by either the purchaser or the Department of Taxation.

(Check proper box below.)

1. Fabrication of foodstuffs supplied by the purchaser for consumption by the purchaser or his family.

2. Fabrication of foodstuffs when the purchaser is an organization exempt from taxation under § 501 (c) (3) or (c) (4) of

the Internal Revenue Code.

3. Fabrication of foodstuffs when the purchaser donates the foodstuffs to an organization exempt from taxation under

§ 501 (c) (3) or (c) (4) of the Internal Revenue Code.

4. Fabrication of foodstuffs for resale.

Certifi cate Of Registration

No., If For Resale

Name of Purchaser

Trading As

Address

Number and street, or rural route

City, town, or post offi ce

State

ZIP

I declare that I am authorized to sign this Certifi cate of Exemption and that, to the best of my knowledge and belief, it is true

and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By (Signature)

Title

If the purchaser is a corporation, an offi cer of the corporation or other person authorized to sign on behalf of the corporation

must sign; if a partnership, one partner must sign; if a sole proprietorship, the proprietor must sign.

Information For Dealer — A dealer is required to have on fi le only one Certifi cate of Exemption properly executed by each

purchaser buying tax exempt fabrication of foodstuffs under this Certifi cate.

Va. Dept. Of Taxation 6201073 ST-24 REV 6/09

1

1