Taxable year beginning ______________________, Ending _______________________

NAME

IDENTIFICATION NUMBER

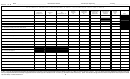

PART II - CALCULATION OF CREDITS

Section 1. CALCULATION OF BUSINESS INVESTMENT AND JOBS EXPANSION TAX CREDIT OR CORPORATE

HEADQUARTERS RELOCATION CREDIT FOR WHICH THE COST IS QUANTIFIABLE

1.

Total qualified investment [From Part I, Section 5, line (e)] ...............................

2.

New jobs percentage (see table below) ................................................................

3.

Total allowable credit (line 1 x line 2) ...................................................................

.10

4.

Taxable year percentage ........................................................................................

5.

Credit allowance(s) for taxable year (line 3 x line 4) ...........................................

Section 2. CALCULATION OF BUSINESS INVESTMENT AND JOBS EXPANSION TAX CREDIT

FOR QUALIFIED INVESTMENTS FOR WHICH THE COST IS NOT QUANTIFIABLE

1.

Total qualified investment [From Part I, Section 6, line (d), column (3)] ...........

2.

New jobs percentage (see table below) ................................................................

3.

Total allowable credit (line 1 x line 2) ...................................................................

.10

4.

Taxable year percentage ........................................................................................

5.

Credit allowance(s) for taxable year (line 3 x line 4) ...........................................

6.

Annual credit allowance for such qualified investments prior year(s) ..............

7.

Credit allowance this taxable year (line 5 plus line 6) .........................................

NOTE: The ten year period begins with the taxable year in which the qualified investment property is placed in service or use,

or, at the taxpayer's election, the next succeeding taxable year. An election to defer applies to all credit attributable to

qualified investment placed into service during the first year only. For the Corporate Headquarters Relocation Credit

or regular or project Business Investment and Jobs Expansion Credit, this election must be made either on the West

Virginia income tax return filed for the taxable year in which credit is first taken and if applicable, on Schedule BCS-A

(Application for Business Investment and Jobs Expansion Credit for Investments Placed into Service or Use on or after

January 1, 1990).

NEW JOBS PERCENTAGE TABLE

NUMBER OF NEW JOBS

NEW JOBS PERCENTAGE

15 to 49 (Corporate Headquarters relocation only)

10%

50 to 279

50%

280 to 519

60%

520 to 759

70%

760 to 999

80%

1000 or more

90%

3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30