NAME

IDENTIFICATION NUMBER

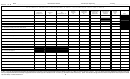

PART VII - RECAP OF ANNUAL CREDIT APPLICATION

Section 1.

a.

Annual Allowance

(1) First year credit was taken 19

b.

Multiple year Projects (See Instructions)

(1) 19

Allowance

(2) 19

Allowance

(3) 19

Allowance

(4) Total

c.

Rebate Carried Forward from Prior Years

( 1) From 1989

( 5) From 1993

( 9) From 1997

(13) From 2001

( 2) From 1990

( 6) From 1994

(10) From 1998

(14) From 2002

( 3) From 1991

( 7) From 1995

(11) From 1999

(15) From 2003

( 4) From 1992

( 8) From 1996

(12) From 2000

(16) Total

d.

Deferred Credit

( 1) From 1993

( 5) From 1997

( 9) From 2001

( 2) From 1994

( 6) From 1998

( 10) From 2002

( 11) From 2003

( 3) From 1995

( 7) From 1999

( 12) Total

( 4) From 1996

( 8) From 2000

Section 2

1. Annual Credit Allowance Available (Current Taxable Year) .................................................

2. Annual Credit Allowance Applied ............................................................................................

3. Rebate Credit Available (Current Taxable Year) ....................................................................

4. Rebate Credit Carried Forward from Prior Years ...................................................................

<

>

5. Rebate Credit Applied ...............................................................................................................

6. Rebate Credit Available for Carryforward ...............................................................................

7. Deferred Credit

.....................................................................................................................

<

>

8. Deferred Credit Applied (Not available until years 11, 12, and 13) .....................................

NOTE: Attach schedule of taxable year(s) and amount(s).

9. Free-Up Credit

.....................................................................................................................

<

>

10. Free-Up Credit Applied ..............................................................................................................

10

24

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30