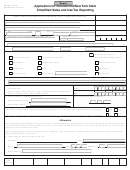

Form Dtf-820 - Certificate Of Nonresidency Of New York State And/or Local Taxing Jurisdiction Page 2

ADVERTISEMENT

Instructions

DTF-820 (2/12) (back)

correct state and local tax rate for New York State addresses.

To the purchaser

You may also use Publication 718, New York State Sales and

This form is to be used by:

Use Tax Rates by Jurisdiction, for this determination.

•

a nonresident of New York State to claim an exemption

Caution: Do not use ZIP codes, including the ZIP code

from both the state and local sales taxes applicable to the

indicated on a purchaser’s driver license, to determine the

purchase of a motor vehicle, trailer, or vessel, provided

appropriate sales tax rate. The use of ZIP codes for tax

that the conditions set forth in box 1 are satisfied, and the

collection purposes results in a high degree of inaccurate tax

purchaser supplies the vendor with a properly completed

reporting.

copy of this certificate prior to taking delivery; or

•

a resident of New York State to claim an exemption from

A registered vendor that, prior to the purchaser’s taking delivery

the local sales tax imposed in the taxing jurisdiction where

of the motor vehicle, trailer, or vessel, accepts in good faith a

the sale takes place applicable to the purchase of a motor

properly completed Form DTF-820 with:

vehicle, trailer, or vessel, provided that the conditions set

•

box 1 marked will be protected from sales tax liability for the

forth in box 2 are satisfied, and the purchaser supplies the

transaction; or

vendor with a properly completed copy of this certificate prior

•

to taking delivery. Note: The seller must collect sales tax

box 2 marked will be protected from liability for failure to

collect tax at the rate in effect where the sale takes place.

at the combined state and local rate in effect in the taxing

jurisdiction where the purchaser resides.

If box 2 is marked, the vendor must collect tax at the combined

For sales and use tax purposes, an individual is a resident

rate in effect where the purchaser indicates the purchaser is a

resident, as described above. The certificate is complete if all

of the state and of any locality in which he or she maintains

a permanent place of abode. A permanent place of abode is

required entries are made. A certificate is accepted in good faith

a dwelling place maintained by a person, or by another for

when a seller, exercising reasonable and ordinary due care,

that person to use, whether or not owned by such person, on

has no knowledge that the certificate is false or is fraudulently

other than a temporary or transient basis. The dwelling may

presented.

be a home, apartment, or flat; a room, including a room at a

hotel, motel, boarding house, or club; a room at a residence

This certificate will not be deemed to be accepted in good faith

hall operated by an educational, charitable, or other institution;

where, for example:

•

housing provided by the armed forces of the United States,

The purchaser marks box 1 and enters a New York State

address in any of the address boxes appearing on the

whether such housing is located on or off a military base or

reservation; or a trailer, mobile home, houseboat, or any other

certificate.

premises. This includes second homes.

•

The purchaser marks box 1 and the seller does a courtesy

registration for the purchaser with the New York State

Box 1 — By marking box 1, the purchaser is claiming an

Department of Motor Vehicles (DMV) or a county clerk.

exemption from both the state and local sales taxes.

•

The purchaser marks box 2 and the seller has knowledge that

Box 2 — By marking box 2, the purchaser is claiming an

the purchaser maintains a permanent place of abode in the

local taxing jurisdiction where the sale occurs.

exemption from the local tax imposed by the taxing jurisdiction

where the sale takes place. In this case, the seller must collect

You must keep this certificate for at least three years after the

sales tax based on the combined state and local tax rate in effect

where the purchaser resides. If the purchaser is an individual,

due date of the return to which it relates, or the date the return

was filed, if later. You must also maintain a method of associating

the applicable rate is the combined state and local rate in effect

an invoice (or other source document) for an exempt sale made

in the taxing jurisdiction where the purchaser has a permanent

to a customer with the certificate you have on file from that

place of abode. If the purchaser is a business, the applicable

customer.

rate is the combined state and local rate in effect in the taxing

jurisdiction where the motor vehicle, trailer, or vessel will be

principally garaged.

Need help?

If marking box 2, the purchaser must enter the purchaser’s

Visit our Web site at

New York State local address, including the number and street,

• get information and manage your taxes online

the city, town, or village, and the county where the purchaser

actually resides. The city, town, or village where the purchaser

• check for new online services and features

actually resides may be different than the city, town, or village

indicated in the purchaser’s mailing address, which is based on the

Sales Tax Information Center:

(518) 485-2889

Post Office servicing the residence and not on the actual physical

location of the residence. If the purchaser has more than one place

To order forms and publications:

(518) 457-5431

of abode in New York, the purchaser must enter the address and

Text Telephone (TTY) Hotline

county for the residence where the motor vehicle, trailer, or vessel

(for persons with hearing and

purchased will be predominantly used. Businesses must provide

speech disabilities using a TTY):

(518) 485-5082

the address in the taxing jurisdiction where the motor vehicle,

trailer, or vessel will be principally garaged.

Privacy notification

The Commissioner of Taxation and Finance may collect and maintain personal information

To the seller

pursuant to the New York State Tax Law, including but not limited to, sections 5-a, 171, 171-a,

By marking box 1, the purchaser is claiming an exemption

287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of

social security numbers pursuant to 42 USC 405(c)(2)(C)(i).

from both the state and local sales taxes. If the purchaser is

purchasing a trailer or vessel, the seller must write Exempt:

This information will be used to determine and administer tax liabilities and, when authorized

out-of-state purchaser on the bill of sale. If the purchaser

by law, for certain tax offset and exchange of tax information programs as well as for any other

lawful purpose.

is purchasing a motor vehicle, the seller must write Exempt:

Information concerning quarterly wages paid to employees is provided to certain state agencies

out-of-state purchaser on Form MV-50, Retail Certificate of

for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain

Sale, as explained in TSB-M-95(2)S, Sales of Motor Vehicles to

employment and training programs and other purposes authorized by law.

Nonresidents and Motor Vehicle Registration by Nonresidents.

Failure to provide the required information may subject you to civil or criminal penalties, or both,

If box 2 is marked, based on the information provided by the

under the Tax Law.

purchaser, use the Sales Tax Jurisdiction and Rate Lookup

This information is maintained by the Manager of Document Management, NYS Tax

Service on our Web site (see Need help?) to determine the

Department, W A Harriman Campus, Albany NY 12227; telephone (518) 457-5181.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2