Arizona Form 285-Sbi - Disclosure Authorization Form (Irrevocable) Small Business Investments Credit - Instructions

ADVERTISEMENT

Disclosure Authorization Form (Irrevocable)

ARIZONA FORM

Small Business Investments Credit

285-SBI

PURPOSE OF FORM

2) All tax years thereafter through the year in which the

investment was made for which a return was not fi led

A taxpayer may use Form 285-SBI to authorize the department

with the Department of Revenue as of the date of the

to release confi dential information to the taxpayer’s appointee.

application; and

The department may have to disclose confi dential information

3) All tax years in which the applicant could claim or carry

to fully discuss tax issues with, or respond to tax questions by,

forward the credit.

the appointee. The form should only be used in conjunction

Small Business: If you are a small business seeking to be

with the application for authorization or certifi cation from

certifi ed pursuant to A.R.S. §43-1074.02, list all of the following

the Arizona Department of Commerce for a credit pursuant

tax years:

to A.R.S. §43-1074.02.

1) The latest two tax years preceding the date the application

Who Can Use Form 285-SBI?

for certifi cation was fi led for which income tax returns

were fi led with the Department of Revenue; and

Any of the following may fi le Form 285-SBI.

2) All tax years thereafter through the years in which a

• An individual

qualifi ed investment was made, or may be made, for which

• Individuals that fi le joint returns

a return was not fi led with the Department of Revenue as

• A sole proprietorship

of the date of the application for certifi cation.

• A corporation

Section 5 - Revocation of Authorization.

• A partnership

This authorization does not revoke any earlier authorizations

• A limited liability company

or powers of attorney on fi le with the Arizona Department of

• An estate

Revenue.

• A trust

This authorization can be revoked only with

• Any other organization, association, or group

written consent of the Arizona Department of

SPECIFIC INSTRUCTIONS

Commerce.

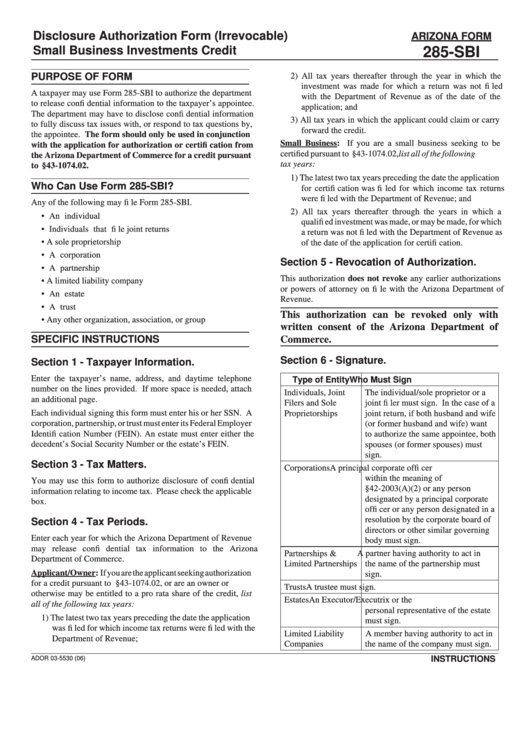

Section 6 - Signature.

Section 1 - Taxpayer Information.

Enter the taxpayer’s name, address, and daytime telephone

Type of Entity

Who Must Sign

number on the lines provided. If more space is needed, attach

Individuals, Joint

The individual/sole proprietor or a

an additional page.

Filers and Sole

joint fi ler must sign. In the case of a

Each individual signing this form must enter his or her SSN. A

Proprietorships

joint return, if both husband and wife

corporation, partnership, or trust must enter its Federal Employer

(or former husband and wife) want

Identifi cation Number (FEIN). An estate must enter either the

to authorize the same appointee, both

decedent’s Social Security Number or the estate’s FEIN.

spouses (or former spouses) must

sign.

Section 3 - Tax Matters.

Corporations

A principal corporate offi cer

within the meaning of A.R.S.

You may use this form to authorize disclosure of confi dential

§42-2003(A)(2) or any person

information relating to income tax. Please check the applicable

designated by a principal corporate

box.

offi cer or any person designated in a

resolution by the corporate board of

Section 4 - Tax Periods.

directors or other similar governing

Enter each year for which the Arizona Department of Revenue

body must sign.

may release confi dential tax information to the Arizona

Partnerships &

A partner having authority to act in

Department of Commerce.

Limited Partnerships

the name of the partnership must

Applicant/Owner: If you are the applicant seeking authorization

sign.

for a credit pursuant to A.R.S. §43-1074.02, or are an owner or

Trusts

A trustee must sign.

otherwise may be entitled to a pro rata share of the credit, list

Estates

An Executor/Executrix or the

all of the following tax years:

personal representative of the estate

1) The latest two tax years preceding the date the application

must sign.

was fi led for which income tax returns were fi led with the

Limited Liability

A member having authority to act in

Department of Revenue;

Companies

the name of the company must sign.

ADOR 03-5530 (06)

INSTRUCTIONS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1