Form 4804 - General Instructions

ADVERTISEMENT

2

Form 4804 (Rev. 4-97)

Page

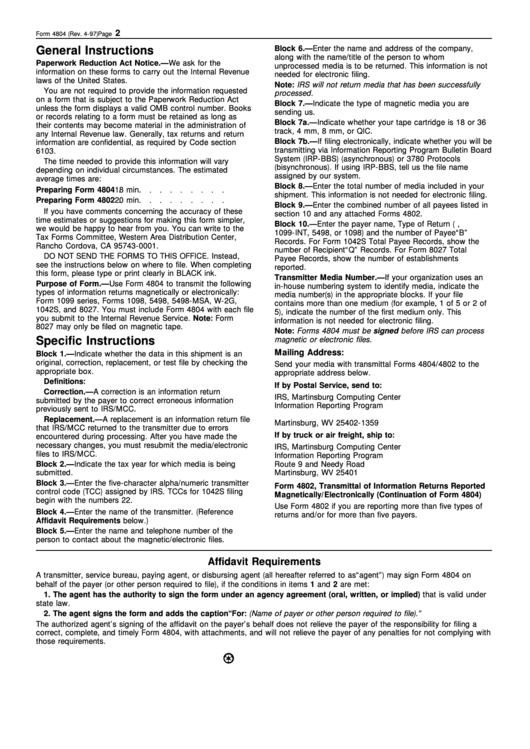

General Instructions

Block 6.—Enter the name and address of the company,

along with the name/title of the person to whom

Paperwork Reduction Act Notice.—We ask for the

unprocessed media is to be returned. This information is not

information on these forms to carry out the Internal Revenue

needed for electronic filing.

laws of the United States.

Note: IRS will not retur n media that has been successfully

You are not required to provide the information requested

processed.

on a form that is subject to the Paperwork Reduction Act

Block 7.—Indicate the type of magnetic media you are

unless the form displays a valid OMB control number. Books

sending us.

or records relating to a form must be retained as long as

Block 7a.—Indicate whether your tape cartridge is 18 or 36

their contents may become material in the administration of

track, 4 mm, 8 mm, or QIC.

any Internal Revenue law. Generally, tax returns and return

Block 7b.—If filing electronically, indicate whether you will be

information are confidential, as required by Code section

transmitting via Information Reporting Program Bulletin Board

6103.

System (IRP-BBS) (asynchronous) or 3780 Protocols

The time needed to provide this information will vary

(bisynchronous). If using IRP-BBS, tell us the file name

depending on individual circumstances. The estimated

assigned by our system.

average times are:

Block 8.—Enter the total number of media included in your

Preparing Form 4804

18 min.

shipment. This information is not needed for electronic filing.

Preparing Form 4802

20 min.

Block 9.—Enter the combined number of all payees listed in

If you have comments concerning the accuracy of these

section 10 and any attached Forms 4802.

time estimates or suggestions for making this form simpler,

Block 10.—Enter the payer name, Type of Return (e.g.,

we would be happy to hear from you. You can write to the

1099-INT, 5498, or 1098) and the number of Payee “B”

Tax Forms Committee, Western Area Distribution Center,

Records. For Form 1042S Total Payee Records, show the

Rancho Cordova, CA 95743-0001.

number of Recipient “Q” Records. For Form 8027 Total

DO NOT SEND THE FORMS TO THIS OFFICE. Instead,

Payee Records, show the number of establishments

see the instructions below on where to file. When completing

reported.

this form, please type or print clearly in BLACK ink.

Transmitter Media Number.—If your organization uses an

Purpose of Form.—Use Form 4804 to transmit the following

in-house numbering system to identify media, indicate the

types of information returns magnetically or electronically:

media number(s) in the appropriate blocks. If your file

Form 1099 series, Forms 1098, 5498, 5498-MSA, W-2G,

contains more than one medium (for example, 1 of 5 or 2 of

1042S, and 8027. You must include Form 4804 with each file

5), indicate the number of the first medium only. This

you submit to the Internal Revenue Service. Note: Form

information is not needed for electronic filing.

8027 may only be filed on magnetic tape.

Note: For ms 4804 must be signed before IRS can process

Specific Instructions

magnetic or electronic files.

Mailing Address:

Block 1.—Indicate whether the data in this shipment is an

original, correction, replacement, or test file by checking the

Send your media with transmittal Forms 4804/4802 to the

appropriate box.

appropriate address below.

Definitions:

If by Postal Service, send to:

Correction.—A correction is an information return

IRS, Martinsburg Computing Center

submitted by the payer to correct erroneous information

Information Reporting Program

previously sent to IRS/MCC.

P.O. Box 1359

Replacement.—A replacement is an information return file

Martinsburg, WV 25402-1359

that IRS/MCC returned to the transmitter due to errors

If by truck or air freight, ship to:

encountered during processing. After you have made the

necessary changes, you must resubmit the media/electronic

IRS, Martinsburg Computing Center

files to IRS/MCC.

Information Reporting Program

Block 2.—Indicate the tax year for which media is being

Route 9 and Needy Road

submitted.

Martinsburg, WV 25401

Block 3.—Enter the five-character alpha/numeric transmitter

Form 4802, Transmittal of Information Returns Reported

control code (TCC) assigned by IRS. TCCs for 1042S filing

Magnetically/Electronically (Continuation of Form 4804)

begin with the numbers 22.

Use Form 4802 if you are reporting more than five types of

Block 4.—Enter the name of the transmitter. (Reference

returns and/or for more than five payers.

Affidavit Requirements below.)

Block 5.—Enter the name and telephone number of the

person to contact about the magnetic/electronic files.

Affidavit Requirements

A transmitter, service bureau, paying agent, or disbursing agent (all hereafter referred to as “agent”) may sign Form 4804 on

behalf of the payer (or other person required to file), if the conditions in items 1 and 2 are met:

1. The agent has the authority to sign the form under an agency agreement (oral, written, or implied) that is valid under

state law.

2. The agent signs the form and adds the caption “For: (Name of payer or other person required to file).”

The authorized agent’s signing of the affidavit on the payer’s behalf does not relieve the payer of the responsibility for filing a

correct, complete, and timely Form 4804, with attachments, and will not relieve the payer of any penalties for not complying with

those requirements.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1