Instructions For Form Ftb 3506 - Child And Dependent Care Expenses Credit Page 2

ADVERTISEMENT

Even if both parents pay for child care for the same child, both parents cannot

2. Nonresidents must have earned income from California sources to

qualify for the credit. Some custody agreements designate which parent

qualify for the credit. A nonresident servicemember’s military wages are

is entitled to the credit. However, the designated parent must meet all the

considered earned income from a California source for the purpose of

qualifications in Section C, Qualifications, to claim the credit. To verify that your

qualifying for the credit.

child meets the requirements to be your qualifying person, use the table below.

3. Part-year residents must have earned income while a California resident

or earned income from California sources while a nonresident to qualify

RULES FOR DIVORCED, RDP TERMINATED, SEPARATED, OR

for the credit.

NEVER-MARRIED PARENTS

G Military Personnel

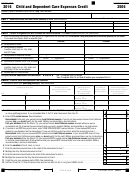

IF

AND

THEN

ALL four of the following apply:

You were the

The child

For the purposes of this credit, active duty pay is considered earned income

custodial parent and

is your

1. Your child was under 13

from California sources, regardless of whether the servicemember is

you can claim the

qualifying

and/or physically or mentally

domiciled in California. The federal Military Spouses Residency Relief Act

dependent exemption

person.

incapable of self-care when

may affect the credit requirements for spouses of military servicemembers.

credit for the child.

the care was provided.

For more information, get FTB Pub. 1032, Tax Information for Military

You were the custodial

The child

Children turning 13 during

Personnel.

parent and under

is your

the year qualify only for the

the provisions of a

qualifying

part of the year they were

Specific Line Instructions

decree of divorce,

person.

12 years old.

legal separation,

2. One of the following applies

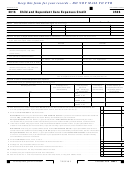

Part I, Unearned Income and Other Funds

termination of

a. You are divorced, legally

registered domestic

Received in 2013

separated, or have

partnership, or a

terminated a registered

List the source and amount of any money you received in 2013 that is not

written separation

domestic partnership.

agreement, the

included in your earned income (Part III, line 4 and line 5) but that was used

b. You are separated under

noncustodial parent

to support your household. Include child support, property settlements,

a written separation

claimed the dependent

agreement.

public assistance benefits, court awards, inheritances, insurance proceeds,

exemption credit,

c. You and the other parent

pensions and annuities, social security payments, workers’ compensation,

or you signed a

lived apart at all times

unemployment compensation, interest, and dividends.

statement releasing

during the last 6 months

Part II, Persons or Organizations Who Provided

the dependent

of the year. (This includes

exemption credit

parents never married to

the Care in California

to the noncustodial

each other.)

parent.

3. One or both parents had

Line 1

custody of the child for more

You are not the

The child

than half the year.

custodial parent.

is not your

Complete line 1a through line 1g for each person or organization that

4. One or both parents provided

qualifying

provided the care in California. Only care provided in California qualifies for

more than half the child’s

person.

the credit. Use federal Form W-10, Dependent Care Provider’s Identification

support for the year.

and Certification, or any other source listed in the instructions for federal

One or more of the four

Use the

Form W-10 to get the information from your care provider. If your provider

statements above do not apply.

“Rules for

does not give you the information, complete as much of the information as

Most People”

possible and explain that your provider did not give you the information you

in Section D.

requested.

Custodial Parent and Noncustodial Parent. The custodial parent is the

If you do not give correct and complete information, we may disallow your

parent with whom the child lived for the greater number of nights during the

credit unless you can show you used due diligence in trying to get the

year. The other parent is the noncustodial parent. If the child lived with each

required information.

parent for an equal number of nights during the year, the custodial parent is

the parent with the higher adjusted gross income.

Lines 1a through Line 1c

Parent Works at Night. If, due to a parent’s night-time work schedule, a child

Enter your California care provider’s complete name (or business name),

lives for a greater number of days, but not nights, with the parent who works

address, and telephone number (including the area code). If you do not give

at night, that parent is treated as the custodial parent. On a school day, the

complete information, we may disallow your credit. We may contact your

child is treated as living at the primary residence registered with the school.

care provider to verify the information you provide.

E Married Persons or RDPs Filing Separate

If you were covered by your employer’s dependent care plan and your

Tax Returns

employer furnished the care (either at your workplace or by hiring a care

provider), enter your employer’s name on line 1a. Next, enter “See W-2” on

Generally, if you are married or an RDP, you must file a joint tax return to claim

line 1b. Complete line 1c through line 1f. Then leave line 1g blank. But, if

the credit. However, you can take the credit on your separate tax return if:

your employer paid a third party (not hired by your employer) on your behalf

to provide care, you must provide information on the third party on line 1a

1. You meet all three requirements below:

through line 1g.

•

You lived apart from your spouse/RDP at all times during the last six

months of 2013.

Line 1d

•

The qualifying person(s) lived in your home more than half of 2013.

•

You provided over half the cost of keeping up your home.

For each care provider, check one box indicating whether the care provider is

a person or organization.

2. You meet all the other qualifications in Section C, Qualifications.

F Nonresidents and Part-Year Residents

1. You must complete and attach Schedule CA (540NR), California

Adjustments – Nonresidents or Part-Year Residents, to your tax

return, Long Form 540NR. If Part I of Schedule CA (540NR) is not fully

completed, we may disallow your credit.

Page 2 FTB 3506 Instructions 2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4