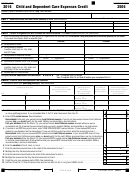

Instructions For Form Ftb 3506 - Child And Dependent Care Expenses Credit Page 3

ADVERTISEMENT

Line 1e

Qualified Expenses are amounts paid for the care of your qualifying person

while you worked or looked for work.

If your care provider is

Then enter on line 1e

An individual

The provider’s social security

Qualified expenses include:

Qualified expenses do not include:

number (SSN) or Individual Taxpayer

•

The cost of care for the

•

Child support payments.

Identification Number (ITIN).

qualifying person’s well-being

•

Payments made to the parent of

Not an individual

The provider’s federal employer

and protection. If care was

your qualifying child.

identification number (FEIN).

provided by a dependent care

•

Payments made to your spouse/

A tax-exempt organization

“Tax-exempt.”

center, the center must meet

RDP.

all applicable state and local

•

Payments made to your child

Line 1f

regulations.

who is under age 19 at the end

•

Cost of pre-school or similar

of the year, even if he or she is

Enter the complete physical address where the care was provided. A post

program below the kindergarten

not your dependent.

office box is not acceptable. If you do not provide correct or complete

level.

•

Payments made to a dependent

information, your credit may be disallowed. Only care provided in California

•

Day camp, even if it specialized

for whom you (or your spouse/

qualifies for the credit.

in a particular activity, such as

RDP) can claim a dependent

soccer.

exemption.

Line 1g

•

Expenses paid by or reimbursed

through a subsidy program.

Enter the total amount you actually paid in 2013 to your care provider for

care provided in California. Also include amounts your employer paid to

•

Cost for education (school

tuition) at the kindergarten level

a third party on your behalf. It does not matter when the expenses were

incurred. Do not reduce this amount by any reimbursement you received.

and above.

•

Overnight camp.

We may ask you to provide proof of payment. Cash payments without

verifiable documentation may not be accepted.

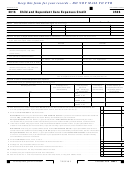

Line 4

Part III, Credit for Child and Dependent Care

Earned income includes:

Earned income does not include:

Expenses

• Wages, salary, tips, and other

• Pensions or annuities

taxable employee compensation,

• Social security payments

Line 2

as well as, military compensation

• Workers’ compensation

including compensation for service

• Interest

Complete column (a) through column (e) for each qualifying person for

in a combat zone.

• Dividends

whom care was provided in California. If claiming more than three qualifying

• Net earnings from

• Capital gains

persons, attach a sheet of paper to your tax return with the required

self-employment.

• Unemployment compensation

information and write “see attached.” Write your name and SSN or ITIN on

• Strike benefits.

• Public assistance

the sheet.

• Disability payments you report as

• California service income

Column (a)

wages.

excluded under the Military

Enter each qualifying person’s name.

• Active duty pay received by

Spouses Residency Relief Act.

Column (b)

servicemembers of the armed

Enter each qualifying person’s SSN. Verify that the name and SSN match

forces is considered earned

the qualifying person’s social security card to avoid the reduction or

income regardless of whether the

disallowance of your credit. If the person was born in, and later died in,

servicemember is domiciled in this

2013, and does not have a SSN, enter “Deceased” in column (b) and attach a

state or elsewhere.

copy of the person’s birth and death certificates.

Column (c)

Enter the qualifying person’s date of birth (mm/dd/yyyy) in the space

Nonresidents and Part-Year

provided or if the qualifying person is disabled (physically or mentally

Residents Only: Earned income

incapable of self-care), check the “Yes” box. Incomplete information could

from California sources includes:

Earned income does not include:

result in a delay or disallowance of your credit.

• Wages, salary, tips, and other

• Pensions or annuities

Column (d)

taxable employee compensation

• Social security payments

If you shared custody of the qualifying person(s), enter the percentage of

for working in California, as

• Workers’ compensation

time you possessed physical custody during 2013. If you have 50% or less

well as, military compensation

• Interest

physical custody of your child, you do not qualify for the credit.

including compensation for

• Dividends

Column (e)

service in a combat zone.

• Capital gains

Enter the qualified expenses you incurred and paid in 2013 for the qualifying

• Net earnings from

• Unemployment compensation

person(s). Include only the qualified expenses for care provided in California.

self-employment from California

• Public assistance

If the child turned 13 years old during the year, include only the qualified

business activities.

• California service income

expenses for the part of the year the child was 12 years old.

• Strike benefits related to

excluded under the Military

Do not include in column (e) qualified expenses:

California employment.

Spouses Residency Relief Act.

• Disability payments you report

• You incurred in 2013 but did not pay until 2014. You may be able to use

as California wages.

these expenses to increase your 2014 credit.

• Active duty pay received by

• You incurred in 2012 but did not pay until 2013. Instead, see instructions

servicemembers of the armed

for line 11.

forces is considered earned

• You prepaid in 2013 for care to be provided in 2014. These expenses

income regardless of whether

may only be used to figure your 2014 credit.

the servicemember is domiciled

A qualified expense does not include the amount you paid for education

in this state or elsewhere.

(school tuition) or the amount you received through a subsidy program.

FTB 3506 Instructions 2013 Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4