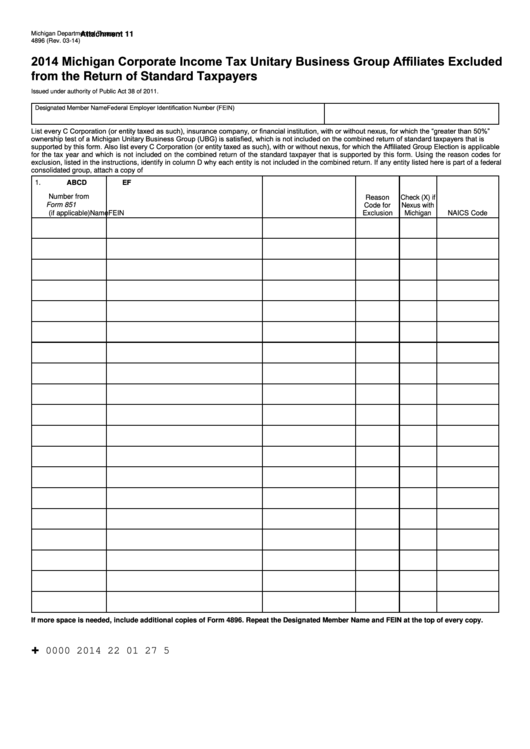

Form 4896 - Michigan Corporate Income Tax Unitary Business Group Affiliates Excluded From The Return Of Standard Taxpayers - 2014

ADVERTISEMENT

Michigan Department of Treasury

Attachment 11

4896 (Rev. 03-14)

2014 Michigan Corporate Income Tax Unitary Business Group Affiliates Excluded

from the Return of Standard Taxpayers

Issued under authority of Public Act 38 of 2011.

Federal Employer Identification Number (FEIN)

Designated Member Name

List every C Corporation (or entity taxed as such), insurance company, or financial institution, with or without nexus, for which the “greater than 50%”

ownership test of a Michigan Unitary Business Group (UBG) is satisfied, which is not included on the combined return of standard taxpayers that is

supported by this form. Also list every C Corporation (or entity taxed as such), with or without nexus, for which the Affiliated Group Election is applicable

for the tax year and which is not included on the combined return of the standard taxpayer that is supported by this form. Using the reason codes for

exclusion, listed in the instructions, identify in column D why each entity is not included in the combined return. If any entity listed here is part of a federal

consolidated group, attach a copy of U.S. Form 851.

1.

A

B

C

D

E

F

Number from

Reason

Check (X) if

U.S. Form 851

Code for

Nexus with

(if applicable)

Name

FEIN

Exclusion

Michigan

NAICS Code

If more space is needed, include additional copies of Form 4896. Repeat the Designated Member Name and FEIN at the top of every copy.

+

0000 2014 22 01 27 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3