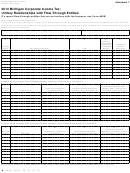

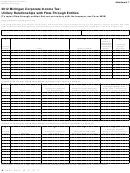

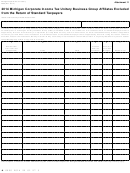

Form 4896 - Michigan Corporate Income Tax Unitary Business Group Affiliates Excluded From The Return Of Standard Taxpayers - 2014 Page 3

ADVERTISEMENT

Instructions for Form 4896

Corporate Income Tax (CIT) Unitary Business Group Affiliates Excluded

from the Return of Standard Taxpayers

standard members: Member A, the DM with a calendar tax year,

Purpose

and Members B and C with fiscal years ending March 31 and

The purpose of this form is to identify every C Corporation

September 30, respectively. Taxpayer ABC’s tax year is that of

(or entity taxed as such), insurance company, and financial

its DM.

institution that meets the Unitary Business Group (UBG)

Line 1A: If an entity being listed here is listed on

control test of MCL 206.603(6) or is a member of a group

U.S. Form 851, enter the identifying number for that entity

for which the Affiliated Group Election of MCL 206.691(2)

that is called “Corp. No.” at the left edge of pages 1, 2, and 3 of

is applicable for the tax year but is not included on the group

U.S. Form 851.

return supported by this form.

Line 1D: Reason codes for affiliates being excluded from the

Line-by-Line Instructions

current combined return:

Lines not listed are explained on the form.

Lacks business activities resulting in a flow of value or

1

integration, dependence or contribution to group.*

For guidance on UBGs for the purpose of this form, see the

“Supplemental Instructions for Standard Members in UBGs”

2

Foreign operating entity.

section in the CIT Forms and Instructions for Standard

3

Foreign entity.

Taxpayers (Form 4890) and the Michigan Department of

4

Member has no CIT tax year (as a member of this UBG)

Treasury Web site at

ending with or within this filing period.

UBG means a group of United States persons that are

Insurance company. (Insurance companies always file

5

corporations, insurance companies, or financial institutions,

separately.)

other than a foreign operating entity, that satisfies the control test

6

Financial institution. (Financial institutions and standard

and relationship test. If an Affiliated Group Election is made (see

taxpayers generally are not included on the same

instructions for Form 4891), the UBG also includes all members

combined return.)

of the affiliated group, as defined in IRC 1504 except that the

9

Other.

group includes only U.S. persons (no foreign persons or foreign

operating entities) that are corporations, financial institutions or

*NOTE: Reason code number 1 does not apply to a member

of an affiliated group that has made the Affiliated Group

insurance companies that satisfy the control test and have made

the election to file as a UBG. Once the election is made, the

Election.

Affiliated Group members are treated as members of a UBG for

A taxpayer is required to retain records to substantiate the

all purposes.

reason(s) for a member’s exclusion from the UBG return.

The control test is satisfied when one of the persons owns or

If you have questions, call Treasury, Technical Services

controls, directly or indirectly, more than 50 percent of the

Section, at (517) 636-4230, to discuss an appropriate entry.

ownership interest with voting rights (or rights comparable to

voting rights) of the other members.

Line 1E: If this entity has nexus with Michigan, enter an “X”

The relationship test is satisfied in one of two ways: The UBG

in this box.

has operations which result in a flow of value between the

Line 1F: Enter the entity’s six-digit NAICS code. For a

members in the UBG, or has operations that are integrated with,

complete list of six-digit NAICS codes, see the U.S. Census

are dependent upon, or contribute to each other.

Bureau Web site at , or enter

the same NAICS code used when filing the U.S. Form 1120,

Flow of value is determined by reviewing the totality of facts

Schedule K; or U.S. Form 1120S.

and circumstances of business activities and operations.

Include completed Form 4896 as part of the tax return filing.

The purpose of this form is to identify entities for which the

ownership test is satisfied, but which are not included on the

combined return supported by this form, either because the

relationship test is not satisfied or because the entity is excluded

by statute. A member whose business activity is not included in

the current combined return because its tax year ends after the

filing period of the UBG should also be listed here.

NOTE: A taxpayer that is a UBG must file a combined return

using the tax year of the Designated Member (DM). The

combined return of the UBG must include each tax year of each

member whose tax year ends with or within the tax year of the

DM. For example, Taxpayer ABC is a UBG comprised of three

49

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3