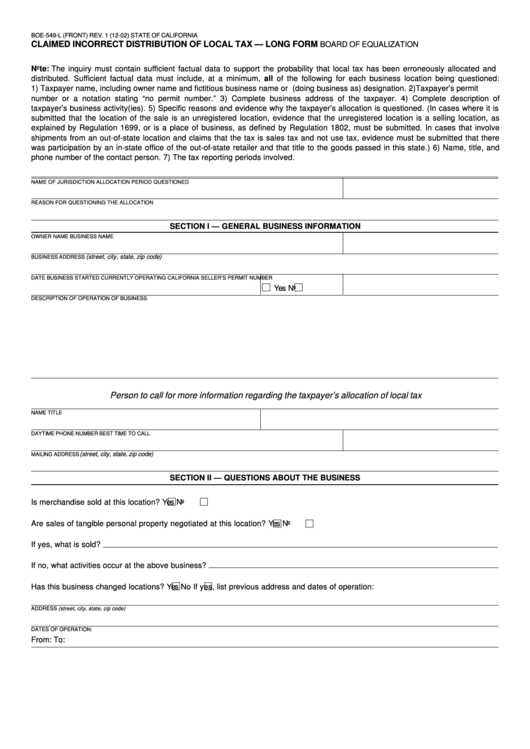

BOE-549-L (FRONT) REV. 1 (12-02)

STATE OF CALIFORNIA

CLAIMED INCORRECT DISTRIBUTION OF LOCAL TAX — LONG FORM

BOARD OF EQUALIZATION

Note: The inquiry must contain sufficient factual data to support the probability that local tax has been erroneously allocated and

distributed. Sufficient factual data must include, at a minimum, all of the following for each business location being questioned:

1) Taxpayer name, including owner name and fictitious business name or d.b.a. (doing business as) designation. 2) Taxpayer’s permit

number or a notation stating “no permit number.” 3) Complete business address of the taxpayer. 4) Complete description of

taxpayer’s business activity(ies). 5) Specific reasons and evidence why the taxpayer’s allocation is questioned. (In cases where it is

submitted that the location of the sale is an unregistered location, evidence that the unregistered location is a selling location, as

explained by Regulation 1699, or is a place of business, as defined by Regulation 1802, must be submitted. In cases that involve

shipments from an out-of-state location and claims that the tax is sales tax and not use tax, evidence must be submitted that there

was participation by an in-state office of the out-of-state retailer and that title to the goods passed in this state.) 6) Name, title, and

phone number of the contact person. 7) The tax reporting periods involved.

NAME OF JURISDICTION

ALLOCATION PERIOD QUESTIONED

REASON FOR QUESTIONING THE ALLOCATION

SECTION I — GENERAL BUSINESS INFORMATION

OWNER NAME

BUSINESS NAME

(street, city, state, zip code)

BUSINESS ADDRESS

DATE BUSINESS STARTED

CURRENTLY OPERATING

CALIFORNIA SELLER’S PERMIT NUMBER

Yes

No

DESCRIPTION OF OPERATION OF BUSINESS

Person to call for more information regarding the taxpayer’s allocation of local tax

NAME

TITLE

DAYTIME PHONE NUMBER

BEST TIME TO CALL

(street, city, state, zip code)

MAILING ADDRESS

SECTION II — QUESTIONS ABOUT THE BUSINESS

Is merchandise sold at this location?

Yes

No

Are sales of tangible personal property negotiated at this location?

Yes

No

If yes, what is sold?

If no, what activities occur at the above business?

Has this business changed locations?

Yes

No If yes, list previous address and dates of operation:

ADDRESS (street, city, state, zip code)

DATES OF OPERATION:

From:

To:

1

1 2

2