Print

Clear

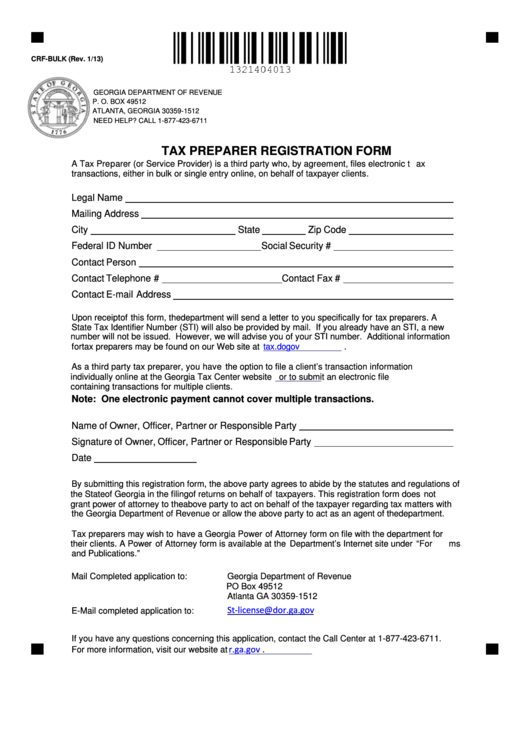

CRF-BULK (Rev. 1/13)

GEORGIA DEPARTMENT OF REVENUE

P. O. BOX 49512

ATLANTA, GEORGIA 30359-1512

NEED HELP? CALL 1-877-423-6711

TAX PREPARER REGISTRATION FORM

A Tax Preparer (or Service Provider) is a third party who, by agreement, files electronic tax

transactions, either in bulk or single entry online, on behalf of taxpayer clients.

Legal Name

Mailing Address

City

State

Zip Code

Federal ID Number

Social Security #

Contact Person

Contact Telephone #

Contact Fax #

Contact E-mail Address

Upon receipt of this form, the department will send a letter to you specifically for tax preparers. A

State Tax Identifier Number (STI) will also be provided by mail. If you already have an STI, a new

number will not be issued. However, we will advise you of your STI number. Additional information

for tax preparers may be found on our Web site at

.

As a third party tax preparer, you have the option to file a client’s transaction information

individually online at the Georgia Tax Center website

gtc.dor.ga.gov

or to submit an electronic file

containing transactions for multiple clients.

Note: One electronic payment cannot cover multiple transactions.

Name of Owner, Officer, Partner or Responsible Party

Signature of Owner, Officer, Partner or Responsible Party

Date

By submitting this registration form, the above party agrees to abide by the statutes and regulations of

the State of Georgia in the filing of returns on behalf of taxpayers. This registration form does not

grant power of attorney to the above party to act on behalf of the taxpayer regarding tax matters with

the Georgia Department of Revenue or allow the above party to act as an agent of the department.

Tax preparers may wish to have a Georgia Power of Attorney form on file with the department for

their clients. A Power of Attorney form is available at the Department’s Internet site under “Forms

and Publications.”

Mail Completed application to:

Georgia Department of Revenue

PO Box 49512

Atlanta GA 30359-1512

St-license@dor.ga.gov

E-Mail completed application to:

If you have any questions concerning this application, contact the Call Center at 1-877-423-6711.

.

For more information, visit our website at

1

1