Tax Preparation Checklist

ADVERTISEMENT

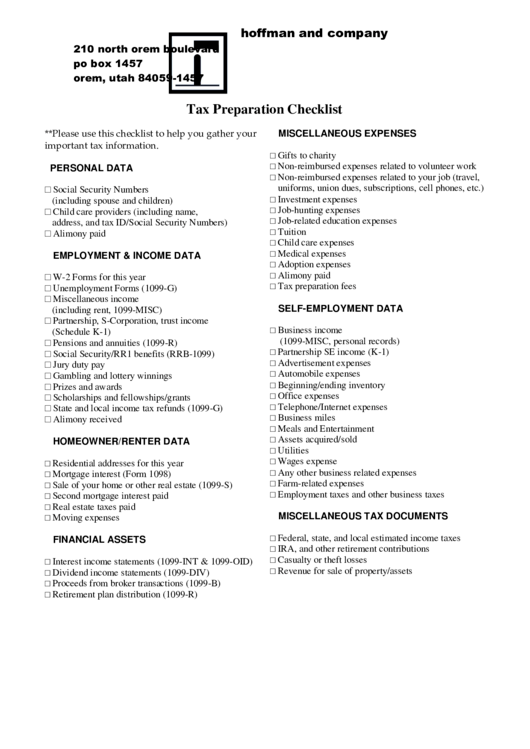

hoffman and company

210 north orem boulevard

po box 1457

orem, utah 84059-1457

Tax Preparation Checklist

MISCELLANEOUS EXPENSES

**Please use this checklist to help you gather your

important tax information.

Gifts to charity

□

Non-reimbursed expenses related to volunteer work

□

PERSONAL DATA

Non-reimbursed expenses related to your job (travel,

□

uniforms, union dues, subscriptions, cell phones, etc.)

□ Social Security Numbers

Investment expenses

(including spouse and children)

□

Job-hunting expenses

□ Child care providers (including name,

□

Job-related education expenses

□

address, and tax ID/Social Security Numbers)

Tuition

□

□ Alimony paid

Child care expenses

□

Medical expenses

EMPLOYMENT & INCOME DATA

□

Adoption expenses

□

Alimony paid

□

□ W-2 Forms for this year

Tax preparation fees

□

□ Unemployment Forms (1099-G)

□ Miscellaneous income

SELF-EMPLOYMENT DATA

(including rent, 1099-MISC)

□ Partnership, S-Corporation, trust income

Business income

(Schedule K-1)

□

(1099-MISC, personal records)

□ Pensions and annuities (1099-R)

Partnership SE income (K-1)

□

□ Social Security/RR1 benefits (RRB-1099)

Advertisement expenses

□

□ Jury duty pay

Automobile expenses

□ Gambling and lottery winnings

□

Beginning/ending inventory

□ Prizes and awards

□

Office expenses

□ Scholarships and fellowships/grants

□

Telephone/Internet expenses

□

□ State and local income tax refunds (1099-G)

Business miles

□

□ Alimony received

Meals and Entertainment

□

Assets acquired/sold

HOMEOWNER/RENTER DATA

□

Utilities

□

Wages expense

□

Residential addresses for this year

□

Any other business related expenses

□

Mortgage interest (Form 1098)

□

Farm-related expenses

Sale of your home or other real estate (1099-S)

□

□

Employment taxes and other business taxes

Second mortgage interest paid

□

□

Real estate taxes paid

□

MISCELLANEOUS TAX DOCUMENTS

Moving expenses

□

Federal, state, and local estimated income taxes

FINANCIAL ASSETS

□

IRA, and other retirement contributions

□

Casualty or theft losses

Interest income statements (1099-INT & 1099-OID)

□

□

Revenue for sale of property/assets

Dividend income statements (1099-DIV)

□

□

Proceeds from broker transactions (1099-B)

□

Retirement plan distribution (1099-R)

□

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2