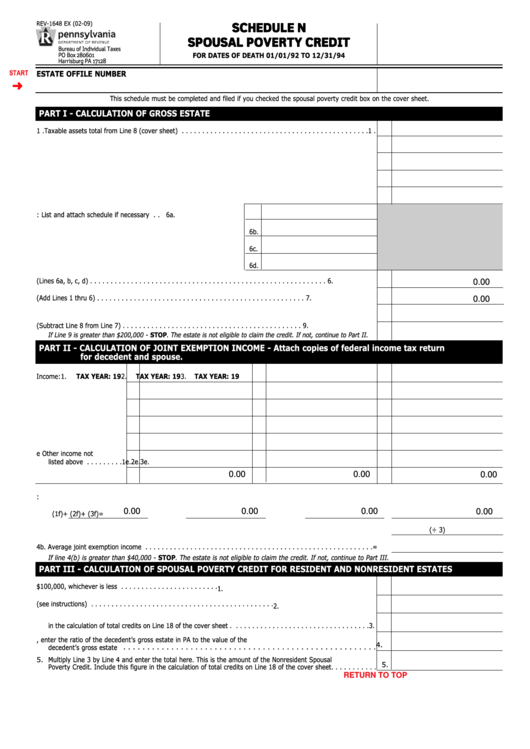

SCHEDULE N

REV-1648 EX (02-09)

SPOUSAL POVERTY CREDIT

Bureau of Individual Taxes

PO Box 280601

FOR DATES OF DEATH 01/01/92 TO 12/31/94

Harrisburg PA 17128

START

ESTATE OF

FILE NUMBER

This schedule must be completed and filed if you checked the spousal poverty credit box on the cover sheet.

PART I - CALCULATION OF GROSS ESTATE

1 . Taxable assets total from Line 8 (cover sheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 .

2. Insurance proceeds on life of decedent

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Retirement benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Joint assets with spouse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. PA Lottery winnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6a. Other nontaxable assets: List and attach schedule if necessary . . 6a.

6b.

6c.

6d.

0.00

6. SUBTOTAL (Lines 6a, b, c, d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

0.00

7. Total gross assets (Add Lines 1 thru 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Total actual liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Net value of estate (Subtract Line 8 from Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

If Line 9 is greater than $200,000 - STOP. The estate is not eligible to claim the credit. If not, continue to Part II.

PART II - CALCULATION OF JOINT EXEMPTION INCOME - Attach copies of federal income tax return

for decedent and spouse.

Income:

1.

TAX YEAR: 19

2.

TAX YEAR: 19

3.

TAX YEAR: 19

a. Spouse . . . . . . . . . . . . . 1a.

2a.

3a.

b. Decedent . . . . . . . . . . . 1b.

2b.

3b.

c. Joint

. . . . . . . . . . . . . . 1c.

2c.

3ci

d. Tax-exempt income . . . . 1d.

2d.

3d.

e

Other income not

listed above . . . . . . . . . 1e.

2e.

3e.

0.00

0.00

0.00

f.

Total

. . . . . . . . . . . . . . 1f.

2f.

3f.

4.

Average joint exemption income calculation

4a. Add joint exemption income from above:

0.00

0.00

0.00

0.00

(1f)

+ (2f)

+ (3f)

=

(÷ 3)

4b. Average joint exemption income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

=

If line 4(b) is greater than $40,000 - STOP. The estate is not eligible to claim the credit. If not, continue to Part III.

PART III - CALCULATION OF SPOUSAL POVERTY CREDIT FOR RESIDENT AND NONRESIDENT ESTATES

1. Insert amount of taxable transfers to spouse or $100,000, whichever is less

. . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Multiply by credit percentage (see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. This is the amount of the Resident Spousal Poverty Credit. Include this figure

in the calculation of total credits on Line 18 of the cover sheet .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. For nonresidents, enter the ratio of the decedent’s gross estate in PA to the value of the

4.

decedent’s gross estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Multiply Line 3 by Line 4 and enter the total here. This is the amount of the Nonresident Spousal

5.

Poverty Credit. Include this figure in the calculation of total credits on Line 18 of the cover sheet. . . . . . . . . . .

Reset Entire Form

RETURN TO TOP

PRINT FORM

1

1