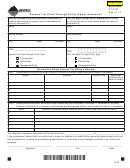

Pass-through Entity Instructions

owner Instructions

What is the purpose of Form Pt-WH?

What does a nonresident individual need to do with

this form?

As provided in Section 15-30-3313, Montana Code Annotated,

a pass-through entity that has a nonresident individual, foreign

We consider the amount of Montana income tax that is withheld

C corporation, or second tier pass-through entity owner at any

as a payment against your Montana individual income tax liability.

time during the tax year who (1) does not have a valid, currently

When you complete your Montana Individual Income Tax Return

effective tax agreement (Form PT-AGR) or statement (Form

(Form 2) you should claim the amount of Montana tax withheld

PT-STM) from the owner, or (2) does not participate in filing a

shown on line 2 as a withholding payment on line 57 of your

Montana Form 2. Form PT-WH or Montana Schedule K-1 has

composite return with the entity, is required to pay tax to the

Department of Revenue on behalf of the owner.

to be included with your Montana Form 2 when you claim this

payment.

How much tax should the pass-through entity pay on

behalf of it owners?

What does a foreign C corporation need to do with this

form?

For a nonresident individual and a second tier pass-through

entity, the amount that has to be paid is 6.9% of the Montana

We consider the amount of Montana income tax that is withheld

source income as reflected on your Montana return. For a foreign

as a payment against the foreign C corporation’s Montana

C corporation, the amount paid is 6.75% of the Montana source

corporation license tax liability. When the corporation completes

income as reflected on your Montana return.

its Montana Corporation License Tax Return (Form CLT-4) it

should claim the amount of Montana tax withheld shown on line 2

Where does a pass-through entity report the amount of

as a withholding payment on line 12e of its Montana Form CLT-4.

tax that was paid on behalf of the owners?

Form PT-WH has to be included with the corporation’s Montana

Form CLT-4 when it claims this payment.

Report the amounts from lines 1 and 2 on:

► Montana Schedule K-1

What does a second tier pass-through entity need to

► Form CLT-4S, Schedule III or Form PR-1, Schedule III

do with this form?

Send Form PT-WH to your owners. We do not require you to

We consider the amount of Montana income tax that is withheld

submit the Form PT-WH with your information return.

as a payment of the second tier partnership’s tax liability which

may be claimed by the owner who ultimately reports the Montana

source income as a refundable credit. The first tier pass-through

entity must give the second tier pass-through entity notice on the

Montana Schedule K-1 of the amount of refundable credit that

may be claimed by the owner who ultimately reports the Montana

source income on individual or corporation license income tax

returns.

Questions? Please call us toll free at (866) 859-2254 (in

Helena, 444-6900).

1

1 2

2