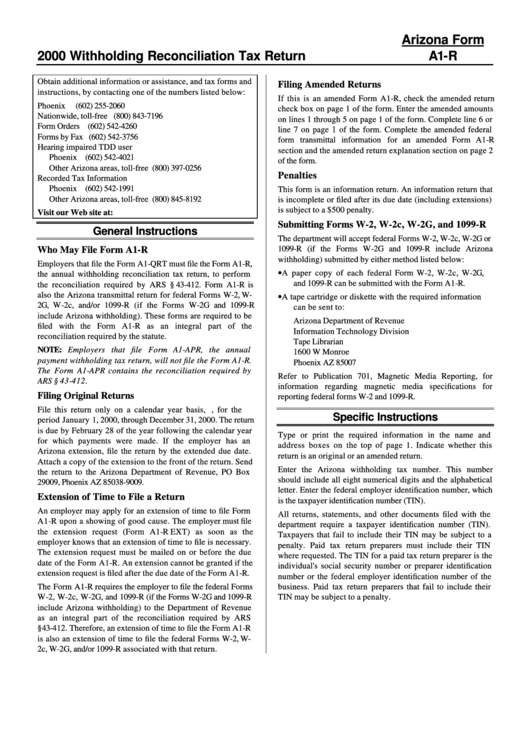

Arizona Form A1-R - General Instructions For Withholding Reconciliation Tax Return - 2000

ADVERTISEMENT

Arizona Form

2000 Withholding Reconciliation Tax Return

A1-R

Obtain additional information or assistance, and tax forms and

Filing Amended Returns

instructions, by contacting one of the numbers listed below:

If this is an amended Form A1-R, check the amended return

Phoenix

(602) 255-2060

check box on page 1 of the form. Enter the amended amounts

Nationwide, toll-free

(800) 843-7196

on lines 1 through 5 on page 1 of the form. Complete line 6 or

Form Orders

(602) 542-4260

line 7 on page 1 of the form. Complete the amended federal

Forms by Fax

(602) 542-3756

form transmittal information for an amended Form A1-R

Hearing impaired TDD user

section and the amended return explanation section on page 2

Phoenix

(602) 542-4021

of the form.

Other Arizona areas, toll-free

(800) 397-0256

Penalties

Recorded Tax Information

Phoenix

(602) 542-1991

This form is an information return. An information return that

Other Arizona areas, toll-free

(800) 845-8192

is incomplete or filed after its due date (including extensions)

is subject to a $500 penalty.

Visit our Web site at:

Submitting Forms W-2, W-2c, W-2G, and 1099-R

General Instructions

The department will accept federal Forms W-2, W-2c, W-2G or

1099-R (if the Forms W-2G and 1099-R include Arizona

Who May File Form A1-R

withholding) submitted by either method listed below:

Employers that file the Form A1-QRT must file the Form A1-R,

•

A paper copy of each federal Form W-2, W-2c, W-2G,

the annual withholding reconciliation tax return, to perform

and 1099-R can be submitted with the Form A1-R.

the reconciliation required by ARS § 43-412. Form A1-R is

•

also the Arizona transmittal return for federal Forms W-2, W-

A tape cartridge or diskette with the required information

2G, W-2c, and/or 1099-R (if the Forms W -2G and 1099-R

can be sent to:

include Arizona withholding). These forms are required to be

Arizona Department of Revenue

filed with the Form A1-R as an integral part of the

Information Technology Division

reconciliation required by the statute.

Tape Librarian

NOTE: Employers that file Form A1-APR, the annual

1600 W Monroe

payment withholding tax return, will not file the Form A1-R.

Phoenix AZ 85007

The Form A1-APR contains the reconciliation required by

Refer to Publication 701, Magnetic Media Reporting, for

ARS § 43-412.

information regarding magnetic media specifications for

Filing Original Returns

reporting federal forms W-2 and 1099-R.

File this return only on a calendar year basis, i.e., for the

Specific Instructions

period January 1, 2000, through December 31, 2000. The return

is due by February 28 of the year following the calendar year

Type or print the required information in the name and

for which payments were made. If the employer has an

address boxes on the top of page 1. Indicate whether this

Arizona extension, file the return by the extended due date.

return is an original or an amended return.

Attach a copy of the extension to the front of the return. Send

Enter the Arizona withholding tax number. This number

the return to the Arizona Department of Revenue, PO Box

should include all eight numerical digits and the alphabetical

29009, Phoenix AZ 85038-9009.

letter. Enter the federal employer identification number, which

Extension of Time to File a Return

is the taxpayer identification number (TIN).

An employer may apply for an extension of time to file Form

All returns, statements, and other documents filed with the

A1-R upon a showing of good cause. The emp loyer must file

department require a taxpayer identification number (TIN).

the extension request (Form A1-R EXT) as soon as the

Taxpayers that fail to include their TIN may be subject to a

employer knows that an extension of time to file is necessary.

penalty. Paid tax return preparers must include their TIN

The extension request must be mailed on or before the due

where requested. The TIN for a paid tax return preparer is the

date of the Form A1-R. An extension cannot be granted if the

individual's social security number or preparer identification

extension request is filed after the due date of the Form A1-R.

number or the federal employer identification number of the

The Form A1-R requires the employer to file the federal Forms

business. Paid tax return preparers that fail to include their

W-2, W-2c, W-2G, and 1099-R (if the Forms W-2G and 1099-R

TIN may be subject to a penalty.

include Arizona withholding) to the Department of Revenue

as an integral part of the reconciliation required by ARS

§ 43-412. Therefore, an extension of time to file the Form A1-R

is also an extension of time to file the federal Forms W-2, W-

2c, W-2G, and/or 1099-R associated with that return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2