Return to Page 1

Instructions for Schedule PS

General Instructions

If your child was a secondary pupil (grades 9 through 12)

for the entire year, fill in the grade number as of January 1

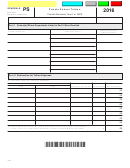

Purpose of Schedule PS

of the year for which the tuition was paid.

Use Schedule PS to claim the subtraction for tuition paid in

If your child was an elementary pupil for part of the year

2015 for your dependent child to attend a private school.

and a secondary pupil for the rest of the year, fill in “8

and 9” in column (c).

Who is Eligible to Claim the Subtraction

If your child attended a private school for only part of the

The subtraction may be claimed by a full-year resident, part-

year, fill in the grade number at the time your child was first

year resident, or nonresident of Wisconsin. You must have

enrolled in the private school.

paid tuition during the taxable year for your child to attend

Tuition Column (d) – If your dependent child was:

an eligible institution. The child must have been claimed as

a dependent on your Wisconsin income tax return, and the

An elementary pupil (grades K-8), fill in the amount you

child must have been an “elementary pupil” or a “secondary

paid for tuition during the taxable year but not more than

pupil” during the taxable year.

$4,000 per pupil.

A secondary pupil (grades 9-12), fill in the amount you

Definitions

paid for tuition during the taxable year but not more than

“Elementary pupil” means an individual who is enrolled in

$10,000 per pupil.

grades kindergarten to 8 at an eligible institution. (Note

Both an elementary pupil and a secondary pupil (grades 8

“Kindergarten” does not include pre-kindergarten, that is,

and 9), fill in the amount you paid for tuition during the taxable

any 3-year old or 4-year old kindergarten.)

year for the period when your child was an elementary

pupil (but not more than $4,000) plus the amount you paid

“Secondary pupil” means an individual who is enrolled in

for the period when your child was a secondary pupil. If the

grades 9 to 12 at an eligible institution.

total is more than $10,000, fill in $10,000.

“Eligible institution” means a private school with an

Tuition includes any amount paid by the claimant for a pupil’s

educational program that meets all of the following criteria:

tuition to attend an eligible institution and mandatory book

• The primary purpose of the program is to provide private

fees paid to the institution.

or religious-based education.

Tuition does not include amounts paid with a voucher or any

• The program is privately controlled.

amounts paid as a separate charge for other items, such as:

• The program provides at least 875 hours of instruction

• room and board

each school year.

• supplies

• The program provides a sequentially progressive cur-

• cap and gown fees

riculum of fundamental instruction in reading, language

• rentals of equipment

arts, mathematics, social studies, science, and health.

• meals

• transportation

• The program is not operated or instituted for the purpose

• registration fees

of avoiding or circumventing the compulsory school

• building fees

attendance requirements.

• personal use items (e.g., uniforms, gym clothes, towels)

• The pupils in the institution’s educational program, in the

• before-school and after-school child care

ordinary course of events, return annually to the homes

• social and extracurricular activities, including musical or

of their parents or guardians for not less than 2 months

athletic activity fees

of summer vacation, or the institution is licensed as a

• high school classes not required for graduation and for

child welfare agency.

which no credits toward graduation are given

Line 3 Add the amounts in column (d). This is your subtraction

Specific Instructions

for private school tuition. Fill in the amount from line 3 of

Schedule PS on line 11 of Form 1 (using code number 22) or

Part I

line 40 of Schedule M of Form 1NPR.

Line 1 Fill in the name, address, and federal employer iden-

tification number (FEIN) of the private school(s) where your

Required Attachments to Return

dependent child/children were enrolled during 2015.

Attach Schedule PS to your Form 1 or 1NPR.

Part II

Additional Information

Line 2 Columns (a) and (b) – Fill in each of your dependent

For more information, you may contact:

child’s first and last name and social security number if you

Wisconsin Department of Revenue

paid private school tuition for that child in 2015.

Customer Service Bureau

PO Box 8949

Grade Column (c) – If your child was:

Madison WI 53708-8949

An elementary pupil (grades kindergarten through 8) for

the entire year, fill in a “K” for kindergarten or the grade

Phone: (608) 266-2486

number as of January 1 of the year for which the tuition

Email:

income@revenue.wi.gov

was paid.

- 2 -

1

1 2

2