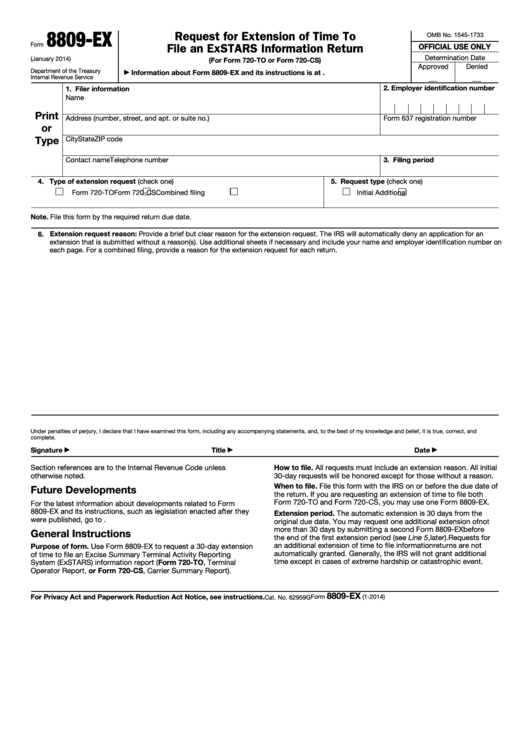

8809-EX

Request for Extension of Time To

OMB No. 1545-1733

Form

File an ExSTARS Information Return

OFFICIAL USE ONLY

Determination Date

(January 2014)

(For Form 720-TO or Form 720-CS)

Approved

Denied

Department of the Treasury

Information about Form 8809-EX and its instructions is at

▶

Internal Revenue Service

2. Employer identification number

1. Filer information

Name

Print

Address (number, street, and apt. or suite no.)

Form 637 registration number

or

Type

City

State

ZIP code

Contact name

Telephone number

3. Filing period

4. Type of extension request (check one)

5. Request type (check one)

Form 720-TO

Form 720-CS

Combined filing

Initial

Additional

Note. File this form by the required return due date.

6. Extension request reason: Provide a brief but clear reason for the extension request. The IRS will automatically deny an application for an

extension that is submitted without a reason(s). Use additional sheets if necessary and include your name and employer identification number on

each page. For a combined filing, provide a reason for the extension request for each return.

Under penalties of perjury, I declare that I have examined this form, including any accompanying statements, and, to the best of my knowledge and belief, it is true, correct, and

complete.

Signature

Title

Date

▶

▶

▶

Section references are to the Internal Revenue Code unless

How to file. All requests must include an extension reason. All initial

otherwise noted.

30-day requests will be honored except for those without a reason.

When to file. File this form with the IRS on or before the due date of

Future Developments

the return. If you are requesting an extension of time to file both

Form 720-TO and Form 720-CS, you may use one Form 8809-EX.

For the latest information about developments related to Form

8809-EX and its instructions, such as legislation enacted after they

Extension period. The automatic extension is 30 days from the

were published, go to

original due date. You may request one additional extension of not

more than 30 days by submitting a second Form 8809-EX before

General Instructions

the end of the first extension period (see Line 5, later). Requests for

an additional extension of time to file information returns are not

Purpose of form. Use Form 8809-EX to request a 30-day extension

automatically granted. Generally, the IRS will not grant additional

of time to file an Excise Summary Terminal Activity Reporting

time except in cases of extreme hardship or catastrophic event.

System (ExSTARS) information report (Form 720-TO, Terminal

Operator Report, or Form 720-CS, Carrier Summary Report).

8809-EX

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(1-2014)

Cat. No. 62959G

1

1 2

2