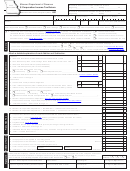

Form Sc 1120s - 'S' Corporation Income Tax Return Page 5

ADVERTISEMENT

Page 5

SC1120S

SCHEDULE SC-K WORKSHEET

* Enter amounts from corresponding lines on your federal Schedule K in Column B.

(A)

(B) *

(C)

(D)

(E)

(F)

Description

Amounts From

Plus or Minus

Federal Schedule K

Col. (D) Amounts Not

Col. (D) Amounts

Federal Schedule K

South Carolina

Amounts After SC

Apportioned or Allocated

Apportioned or

Adjustments

Adjustments

to SC

Allocated to SC

Ordinary business

1

income (loss)

Net rental real

estate income (loss)

2

Other net rental

income (loss)

3

Interest income

4

Dividends

5

Royalties

6

Net short-term

capital gain (loss)

7

Net long-term

capital gain (loss)

8

Net section

1231 gain (loss)

9

Other income (loss)

10

Section 179 deduction

11

Contributions

12a

Investment

interest expense

12b

Section 59(e)(2)

expenditures

12c

Other deductions

12d

. . . . . . . . . . . . . . . . . . . . . . . . . . .

Non-Refundable Tax Credits: Enter Total Credits from SC1120-TC . . . . . .

SC1120-TC must be attached to return.

ATTACH COMPLETE COPY OF FEDERAL RETURN

Make check payable to: SC Department of Revenue. Include Business Name, FEIN and SC File Number.

Go to , eServices, File & Pay Now, DORePay for other payment options.

30955033

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7