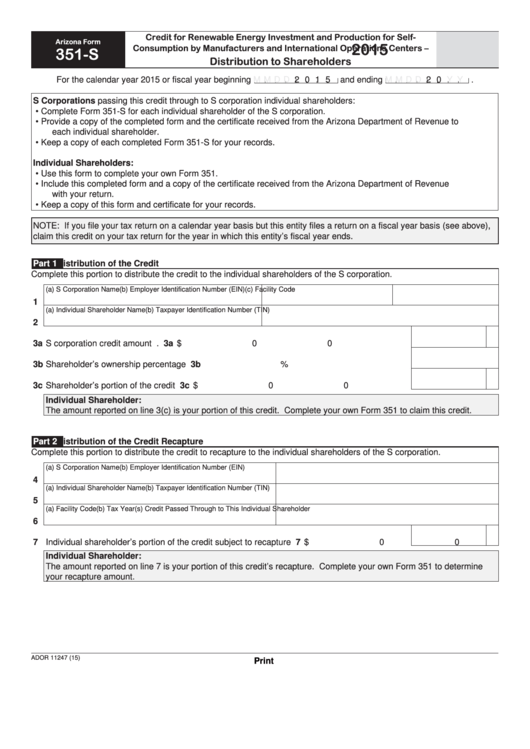

Credit for Renewable Energy Investment and Production for Self-

Arizona Form

2015

Consumption by Manufacturers and International Operations Centers –

351-S

Distribution to Shareholders

For the calendar year 2015 or fiscal year beginning

2 0 1 5 and ending

.

M M D D

M M D D

2 0

Y Y

S Corporations passing this credit through to S corporation individual shareholders:

• Complete Form 351-S for each individual shareholder of the S corporation.

• Provide a copy of the completed form and the certificate received from the Arizona Department of Revenue to

each individual shareholder.

• Keep a copy of each completed Form 351-S for your records.

Individual Shareholders:

• Use this form to complete your own Form 351.

• Include this completed form and a copy of the certificate received from the Arizona Department of Revenue

with your return.

• Keep a copy of this form and certificate for your records.

NOTE: If you file your tax return on a calendar year basis but this entity files a return on a fiscal year basis (see above),

claim this credit on your tax return for the year in which this entity’s fiscal year ends.

Distribution of the Credit

Part 1

Complete this portion to distribute the credit to the individual shareholders of the S corporation.

(a) S Corporation Name

(b) Employer Identification Number (EIN) (c) Facility Code

1

(a) Individual Shareholder Name

(b) Taxpayer Identification Number (TIN)

2

3a S corporation credit amount .................................................................................................... 3a $

00

3b Shareholder’s ownership percentage ...................................................................................... 3b

%

3c Shareholder’s portion of the credit .......................................................................................... 3c $

00

Individual Shareholder:

The amount reported on line 3(c) is your portion of this credit. Complete your own Form 351 to claim this credit.

Part 2

Distribution of the Credit Recapture

Complete this portion to distribute the credit to recapture to the individual shareholders of the S corporation.

(a) S Corporation Name

(b) Employer Identification Number (EIN)

4

(a) Individual Shareholder Name

(b) Taxpayer Identification Number (TIN)

5

(a) Facility Code

(b) Tax Year(s) Credit Passed Through to This Individual Shareholder

6

7 Individual shareholder’s portion of the credit subject to recapture ..........................................

7 $

00

Individual Shareholder:

The amount reported on line 7 is your portion of this credit’s recapture. Complete your own Form 351 to determine

your recapture amount.

ADOR 11247 (15)

Print

1

1