Instructions For Completion Of Form Gas-1276 - International Fuel Tax Agreement (Ifta) Return Page 2

ADVERTISEMENT

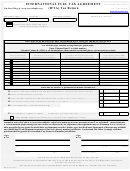

Form Gas 1276 IFTA-I (Reverse)

Column (8) Tax Rate - Use the tax rate sheet (Gas-1278) to enter the tax rate by jurisdiction by product type.

Column (9) Tax or (Credit) - Multiply Column 7 by Column 8.

Column (10) Interest - If your return is late, you will be subject to interest for each jurisdiction on which tax is due (Column 9). For

jurisdictions with surcharges, add the tax to or subtract the credit from the surcharge amount. If the result is a tax due, interest is calculated

on this amount. To calculate the interest payment, multiply the TAX DUE (Column 9) by the interest rate by the number of months late.

A partial month is considered a full month when determining the number of months late. The current interest rate is (5%) per year. DO

NOT CALCULATE INTEREST FOR CREDITS.

Column (11) Total Tax or (Credit) Due - Add the totals of Column 9 and Column 10 for each jurisdiction listed.

SUBTOTALS - Add the subtotals for each page and enter the total tax and total interest on Page 1, Lines 1 and 3.

PAGE 1 - Computation of Tax or (Credit)

Tax or (Credit) Due - Enter the total tax or (credit) due, Schedule B, Column 9, all pages. If the amount on

Line 1

Line 1 is a (credit) then fill in the circle to the left of the boxes to denote a credit amount. Do not use parenthesis

or dashes.

Penalty - Returns are due on the last day of the month following the close of each quarter.

Line 2

a.

If return is late and no tax due, penalty of $50 is due.

b.

If return is late and tax is due, penalty of $50 PLUS 10% of tax due or $50, whichever is greater, is due

c.

If return is on time but underpaid, 10% of tax due or $50, whichever is greater, is due.

Interest Due - Enter the total interest due, Schedule B, Column 10, all pages.

Line 3

Total Balance or (Credit) Due - Add Lines 1 through 3.

Line 4

1.

If Balance Due - Mail the return and a check for the balance due to the North Carolina Department of Revenue, Excise

Tax Division, P. O. Box 25000, Raleigh, NC 27640-0950.

Any payment must be drawn on a U.S. (domestic) bank and payable in U.S. dollars.

2.

If (Credit) Due - fill in the circle to the left of the boxes to denote a credit amount. Do not use parenthesis

or dashes.

Mail the return to the North Carolina Department of Revenue, Excise Tax Division, P. O. Box 25000, Raleigh, NC

27640-0950. Refunds less than $1.00 must be requested in writing.

Please include your signature, title, date, and telephone number.

Anyone who fails to file a return on time will be subject to a penalty of $50.00 for each offense. This penalty is in addition to the

penalty for failure to pay tax when due. In addition, your license plate(s) will be subject to revocation if returns and/or payments

are not submitted to this Department.

MAIL TO:

QUESTIONS:

North Carolina Department of Revenue

Contact the Excise Tax Division at:

Telephone Number

(919) 707-7500

Excise Tax Division

Post Office Box 25000

Toll Free Number

(877) 308-9092

Raleigh, North Carolina 27640-0950

Fax Number

(919) 733-8654

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2