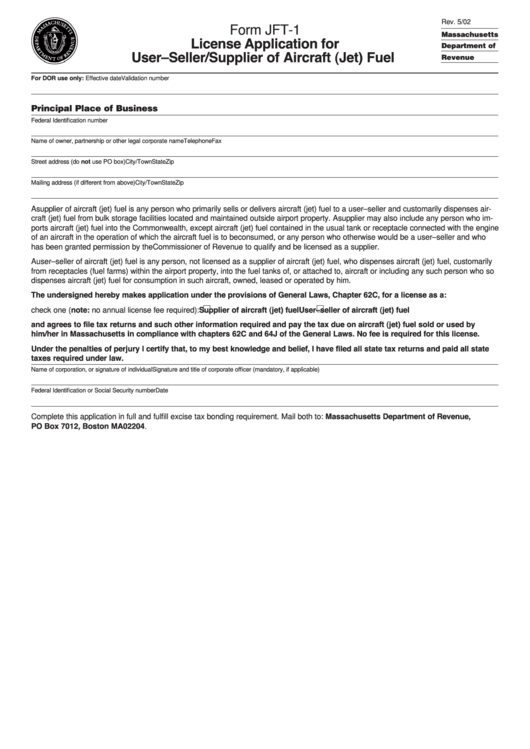

Form Jft-1 - License Application For User-Seller/supplier Of Aircraft (Jet) Fuel

ADVERTISEMENT

Rev. 5/02

Form JFT-1

Massachusetts

License Application for

Department of

User–Seller/Supplier of Aircraft (Jet) Fuel

Revenue

For DOR use only: Effective date

Validation number

Principal Place of Business

Federal Identification number

Name of owner, partnership or other legal corporate name

Telephone

Fax

Street address (do not use PO box)

City/Town

State

Zip

Mailing address (if different from above)

City/Town

State

Zip

A supplier of aircraft (jet) fuel is any person who primarily sells or delivers aircraft (jet) fuel to a user–seller and customarily dispenses air-

craft (jet) fuel from bulk storage facilities located and maintained outside airport property. A supplier may also include any person who im-

ports aircraft (jet) fuel into the Commonwealth, except aircraft (jet) fuel contained in the usual tank or receptacle connected with the engine

of an aircraft in the operation of which the aircraft fuel is to be consumed, or any person who otherwise would be a user–seller and who

has been granted permission by the Commissioner of Revenue to qualify and be licensed as a supplier.

A user–seller of aircraft (jet) fuel is any person, not licensed as a supplier of aircraft (jet) fuel, who dispenses aircraft (jet) fuel, customarily

from receptacles (fuel farms) within the airport property, into the fuel tanks of, or attached to, aircraft or including any such person who so

dispenses aircraft (jet) fuel for consumption in such aircraft, owned, leased or operated by him.

The undersigned hereby makes application under the provisions of General Laws, Chapter 62C, for a license as a:

check one (note: no annual license fee required):

Supplier of aircraft (jet) fuel

User–seller of aircraft (jet) fuel

and agrees to file tax returns and such other information required and pay the tax due on aircraft (jet) fuel sold or used by

him/her in Massachusetts in compliance with chapters 62C and 64J of the General Laws. No fee is required for this license.

Under the penalties of perjury I certify that, to my best knowledge and belief, I have filed all state tax returns and paid all state

taxes required under law.

Name of corporation, or signature of individual

Signature and title of corporate officer (mandatory, if applicable)

Federal Identification or Social Security number

Date

Complete this application in full and fulfill excise tax bonding requirement. Mail both to: Massachusetts Department of Revenue,

PO Box 7012, Boston MA 02204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2